Enterprise Management Incentives explained

The Enterprise Management Incentive (EMI) scheme is used by more than 18,000 UK companies. Read on to find out why it's so popular.

Short on time? Schedule a free call with one of our equity experts and get your questions answered.

Written by Rachel Krish

Rachel Krish is an Equity Consultant at Vestd.

Page last updated: 4 December 2025

EMI is expanding

As you read this guide, keep in mind that, from April 2026, higher limits and rules will apply:

- Employee limit rising from 250 to 500

- Gross assets test increasing to £120m

- Option value limit rising to £6m

- Option holding period extended to 15 years

- EMI notifications removed from April 2027

Curious how this affects you? Chat with a share scheme specialist.

On this page, you'll find all the information you need to compare Enterprise Management Incentives with other share schemes, start an EMI scheme for your employees, and make the proper notifications to HMRC. You'll also find links to helpful resources, including our EMI eligibility quiz and calculators.

Contents

What is an EMI scheme?

An Enterprise Management Incentive (EMI) scheme, is a government-backed, tax-advantageous share options scheme.

Due to its requirements and tax advantages, an EMI share scheme is most attractive to UK-based SMEs seeking to share their success with a small to medium-sized team (under 250 employees).

How do EMI schemes work?

In short, by giving employees the opportunity to have skin in the game in the most tax-efficient way possible.

EMIs not only reward your employees with equity in a way that is hugely tax-efficient but also allow you to offset both the cost of the scheme and the tax benefits achieved by your employees against your company’s tax liability.

EMI option schemes are relatively flexible, in terms of both the conditionality and the time frames that can be set as part of their terms. You also have the ability to set conditions for recipients, including performance or length-of-service milestones.

If you’re thinking about sharing ownership with your employees, make EMI your first port of call. If you're eligible, there's no better share scheme to set up.

Why do businesses give EMI options to employees?

EMI option schemes allow businesses to:

- Attract and retain the best people over longer periods of time.

- Align interests by giving employees a sense of ownership in your company.

- Reward those who help you grow the business by enabling them to share in its success.

- Benefit from a more committed and engaged workforce: businesses with share schemes tend to outperform businesses that don't share ownership with employees.

Additionally, the tax benefits of an EMI option scheme are more beneficial to employees than the alternatives, which you can read about below.

How does a business qualify for an EMI scheme?

A business will usually qualify for an EMI scheme if it meets the following:

-

Has up to 249 employees.

-

Has assets of less than £30m.

-

Is not majority owned or controlled by another company.

-

Is not in one of the excluded industries, including banking, farming, property development, provision of legal services, shipbuilding, or leasing.

Take our quick quiz to find out if your business is eligible today!

Who qualifies for EMI?

There are also eligibility requirements for individual employees:

-

They must spend at least 25 hours per week or 75% of their total working time as a company employee.

-

They may not hold more than 30% of the company's shares.

-

They may not hold options worth more than £250,000 (at the time of grant).

Check out the full list of EMI qualifications for individuals.

Learn more

Everything there is to know about Enterprise Management Incentives in one place.

EMI schemes vs others

The chart below outlines the main differences between EMI options, CSOPs, growth shares, unapproved options and ordinary shares (the key differences being tax):

| EMI | CSOP | Unapproved options | Growth shares | Ordinary shares | |

|---|---|---|---|---|---|

Tax-efficient for staff |

✓ |

✓ |

✗ (rarely) |

✓ |

✗ |

Tax-efficient for non-employees |

✗ N/A |

✗ N/A |

✗ N/A |

✓ |

✗ |

No tax on award |

✓ |

✓ |

✓ (depends) |

✓ |

✗ |

No tax on exercise |

✓ (only if the exercise price is at or above the value approved by HMRC) |

✓ (providing three years have passed since the option grant date) |

✗ (Income Tax based on exercise value)

|

N/A

|

N/A

|

No Income Tax on sale |

✓ (CGT, but at a lower rate) |

✓ (CGT) |

✓ (CGT) |

✓ (CGT) |

✓ (CGT) |

Benefits from BADR (even if below 5% equity) |

✓ (if shares / options held for 24 months) |

✗ |

✗ |

✗ |

✗ |

Shares issued immediately |

✗ |

✗ |

✗ |

✓ |

✓ |

Share options* |

✓ |

✓ |

✓ |

✗ |

✗ |

Conditional shares** |

✓ |

✓ |

✓ |

✓ |

✗ |

Typically given in exchange for capital |

✗ |

✗ |

✗ |

✗ |

✓ |

* Shares issued at a later date, at a pre-agreed price.

** Ability to set specific requirements that must be met to complete share ownership.

As you can see, compared to other share option schemes available to UK-based businesses, EMIs are the most tax-efficient option for both businesses and employees.

Tax is incurred only on the value of the shares at the time of their award rather than at the time of exercise (at which their value may have risen).

Additionally, Capital Gains Tax (CGT) is applied at a lower rate versus the standard rate (so long as the shares are not sold within 24 months of the option grant).

That's because EMI options are eligible for Business Asset Disposal Relief (BADR) so long as a few conditions are met. At present, the rate is 14% and will remain that way for the rest of the current tax year. In the 2026/27 tax year, it will rise to 18%.

Standard Capital Gains Tax is now charged at 18% for basic rate taxpayers, or 24% for higher or additional rate taxpayers.

EMI tax advantages for companies

Businesses offering EMIs can claim Corporation Tax (CT) relief when employees exercise their options.

-

The relief is usually equal to the difference between what the employee pays for their shares and the market value of those shares at the time of exercise.

-

In practice, this means the company gets a tax deduction when employees benefit, helping offset the cost of running the scheme.

EMI tax advantages for employees

Employees enjoy several valuable tax advantages under EMI schemes:

-

No tax on grant – there is no Income Tax or NICs to pay when options are granted.

-

No tax on exercise – provided the options were granted at or above the market value at grant and all EMI conditions remain met.

-

Discounted options – if options are granted below market value, Income Tax and NICs may be due on the discount when exercised.

-

Capital Gains Tax (CGT) on sale – gains made when the shares are eventually sold are normally subject to CGT.

-

Business Asset Disposal Relief (BADR) – employees may qualify for a reduced CGT rate if shares are sold at least 24 months after the grant:

-

14% from 6 April 2025

-

18% from 6 April 2026

-

In short, EMIs create a win-win: valuable tax reliefs for employees and meaningful savings for employers.

EMI disqualifying events

If there is a disqualifying event that causes your business, an employee, or the options scheme to no longer meet the qualifying criteria, the options will lose their advantaged tax status unless they are exercised within 90 days of the event.

For more details on the tax implications of EMIs, we suggest reading one of the pages linked above, this summary or seeking advice from your tax professional.

What happens to an employee's EMI options if they leave?

An employee leaving the company is classed as a disqualifying event. So employees must exercise their EMI options within 90 days, otherwise, any gains will be subject to Income Tax and possibly National Insurance.

Watertight EMI option agreements include leaver clauses, which outline what will happen to an employee's options depending on the circumstances surrounding their departure.

If an employee has truly earned their slice of the pie, we see no reason why they shouldn't get to share in the value they helped to create. That's where the notion of 'good leavers' and 'bad leavers' comes in.

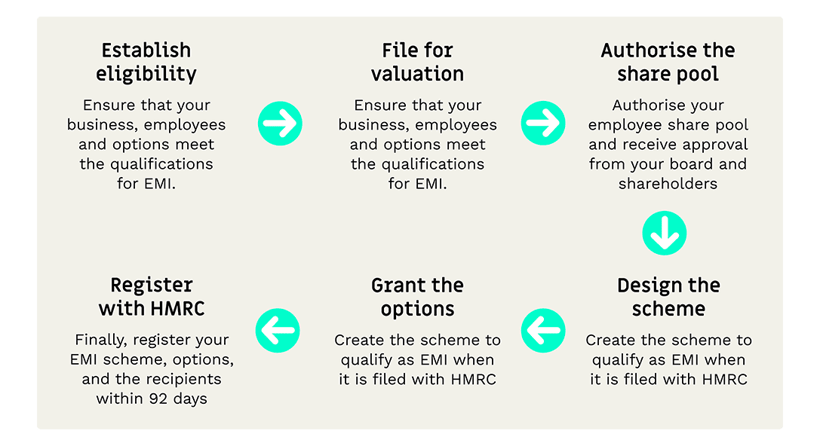

What does the EMI scheme setup process look like?

There are six key steps to get an EMI scheme up and running:

-

Establish eligibility

-

File for valuation

-

Authorise share pool

-

Design the scheme

-

Grant the options

-

Register with HMRC

Let's break it down:

Once you have established your eligibility for Enterprise Management Incentives, the owner must file with HMRC to receive a valuation for approval. It's valid for 90 days and provides some certainty regarding tax treatment going forward, as long as all due criteria and processes are followed.

Once the valuation is agreed upon, you will need to authorise your employee share pool and receive approval from your board and any shareholders. After this, you can design your scheme and grant options to employees.

Finally, your business must register its EMI scheme, options, and recipients with HMRC within 92 days of its first option grant.

This process can be challenging for business owners, who have many other things to focus on. And this is precisely why we built Vestd.

The platform - and our team of EMI experts - can assist with the setup of your EMI scheme, help you generate a valuation and file it with HMRC, create dynamic vesting schedules, and make the long-term management of your issued options easier.

By using our share scheme platform, you'll avoid hassles and unnecessary costs and ensure that your business stays compliant through to exit.

How do I manage an EMI option scheme?

Long term, you will need to manage your Enterprise Management Incentive scheme by adding new recipients, removing recipients, and updating your cap table to reflect the current options issued.

You will also need to notify HMRC of any changes, such as new option grants, employee departures, or a company exit (buyout or change in ownership).

Managing your EMI scheme on your own can be very difficult and time-consuming. And the cost of getting it wrong is dear.

By using Vestd, you will have access to features that help you manage your scheme without any hassle.

Frequently asked questions

-

How long do EMI options last?

EMI options must be capable of being exercised within 10 years from the date of grant. If the options are not exercised within this period, they will lapse.

-

What are the grant limits for EMI options?

-

Individual limit

An employee can be granted EMI options over shares worth up to £250,000 (unrestricted market value at the date of grant) in any three-year period.

-

Company limit

At any one time, a company can have no more than £3 million worth of unexercised EMI options in issue. The value is based on the unrestricted market value of the shares at the time the options are granted.

-

Re-granting restrictions

If an employee has already been granted EMI options up to the £250,000 individual limit, no further qualifying EMI options can be granted to them until three years after the date of their last EMI grant - even if some of those earlier options have since been exercised or released.

-

-

Can I use EMI alongside another scheme?

More often than not, yes! For example, some businesses choose EMI for their UK-based employees and reward non-employees or key people overseas with growth shares.

-

Do I need a new EMI valuation after a funding round?

Yes. A fresh fundraising round, or any material change in the company’s circumstances, will normally invalidate the previous valuation. A new valuation must be agreed with HMRC before issuing further EMI options.

-

Can EMI options be granted over existing shares?

Yes. Granting EMI options over existing shares can minimise dilution for other shareholders and potential investors.

Things to note:

-

The option holder pays the exercise price directly to the shareholder.

-

Stamp duty may apply if the exercise price exceeds £1,000.

-

Legal and tax advice is recommended to ensure compliance.

-

Further reading and resources

We have a ton of guides to help UK startups, SMEs, and their teams fully understand EMI. Check out the links below:

- Full EMI eligibility details

- EMI eligibility quiz

- How HMRC EMI valuations work

- How to grant EMI options to employees

- How to select a vesting schedule for your EMI scheme

- How to exercise EMI options

- EMI tax benefits explained

- EMI blogs

- The Joy of Enterprise Management Incentives

- The Complete EMI Share Option Scheme Checklist

Calculators

- EMI vs Growth Shares calculator

- EMI vs Unapproved Options calculator

- EMI vs Growth Shares vs Unapproved Options calculator

- Calculate how many shares to allocate to your EMI option pool

Videos

Our team, content and app can help you make informed decisions. However, any guidance and support should not be considered as 'legal, tax or financial advice.'