How to select vesting schedules for your EMI share options

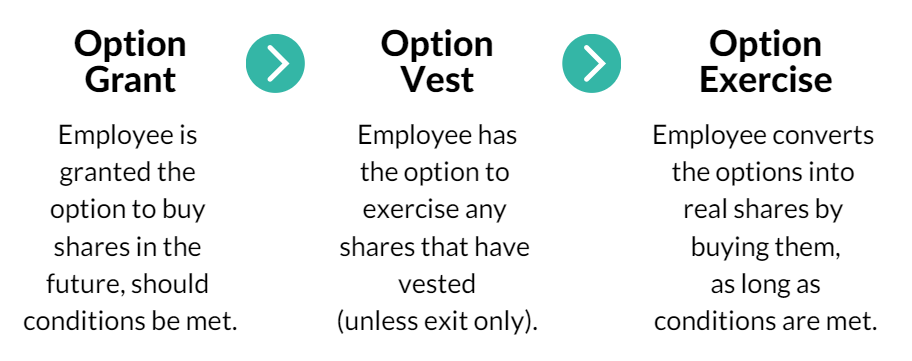

When EMI share options are issued, they have an associated vesting schedule. For EMI option schemes, options may either “vest” and gain their full value over time or immediately convert to exercisable shares upon an “exit.”

You will need to determine when and how fully vested options become available to employees when issued as part of your EMI share scheme.

Selecting a vesting schedule for EMI options

If you do not opt for exit-based options (as described below), you will need to decide on a vesting schedule for your EMI scheme. It is very rare to award employees shares without a vesting period — typically only investors receive ordinary shares up front.

There are multiple choices you may make for your EMI scheme's vesting schedule, including the following:

- Length of time: Issued options may vest monthly, quarterly, annually, or on another schedule. Many UK businesses opt for monthly vesting across a four-year period.

- Cliff vesting: Many organisations require that their employees complete a “cliff” period before any issued options begin to vest, after which they do so on a set schedule. This cliff is usually one year but can be longer.

- Performance criteria: Some organisations attach performance requirements to the vesting of their EMI options, either for specific employees (such as sales or leadership) or for all employees. These requirements may include company valuation reaching a specific amount; monthly or annual revenue (MRR/ARR) increasing to a specific amount; or other trackable, data-based milestones.

Allowing EMI options to become shares on exit only

If you prefer an “exit only” scenario, then although you may still set a vesting schedule (and most companies do), the EMI options issued to your employees will only become exerciseable into shares upon an exit. Exit-based options are popular among businesses working toward the goal of an eventual sale or acquisition.

Exits include

- The sale of your company to another

- Acquisition by a larger company

- A management buyout or other significant change of control

The only way that these options can become fully vested is in the event of an exit. Once an exit occurs, employees will be immediately able to sell their shares (if desired).

Further reading on EMI vesting schedules

To learn more about determining a vesting schedule for your EMI share scheme, please consult the following resources:

- UK.GOV: Requirements Related to Options — Important details to know regarding the requirements you must follow for any EMI options issued to employees, whether they have a vesting schedule or are exit-based.

- What Vesting Schedule is Right for Your EMI Share Scheme? — Our detailed resource for selecting the best vesting schedule for EMI, including data from Vestd customers.

- Taxation and Exercise — After options have been vested (or an exit has occurred), you will need to know this important information about how EMI shares are taxed upon exercise.

Schedule a free, no obligation equity consultation

Get on the fast-track via a call with one of our experts...

Talk to an expert