The cap table: What is it and why do I need one?

A clear grasp of your cap table is key to managing ownership - as we explain in this guide.

Get a free digital cap today.

Written by Stewart Robb

Stewart is an Equity Consultant at Vestd.

Page last updated: 1 October 2025

In this guide, we'll cover cap table basics. That includes what a cap table is, why your startup needs one and how to give it the love and attention it deserves. As well as a whistle-stop tour of our cap table management software, designed to make your life easier.

Contents

What's a capitalisation table?

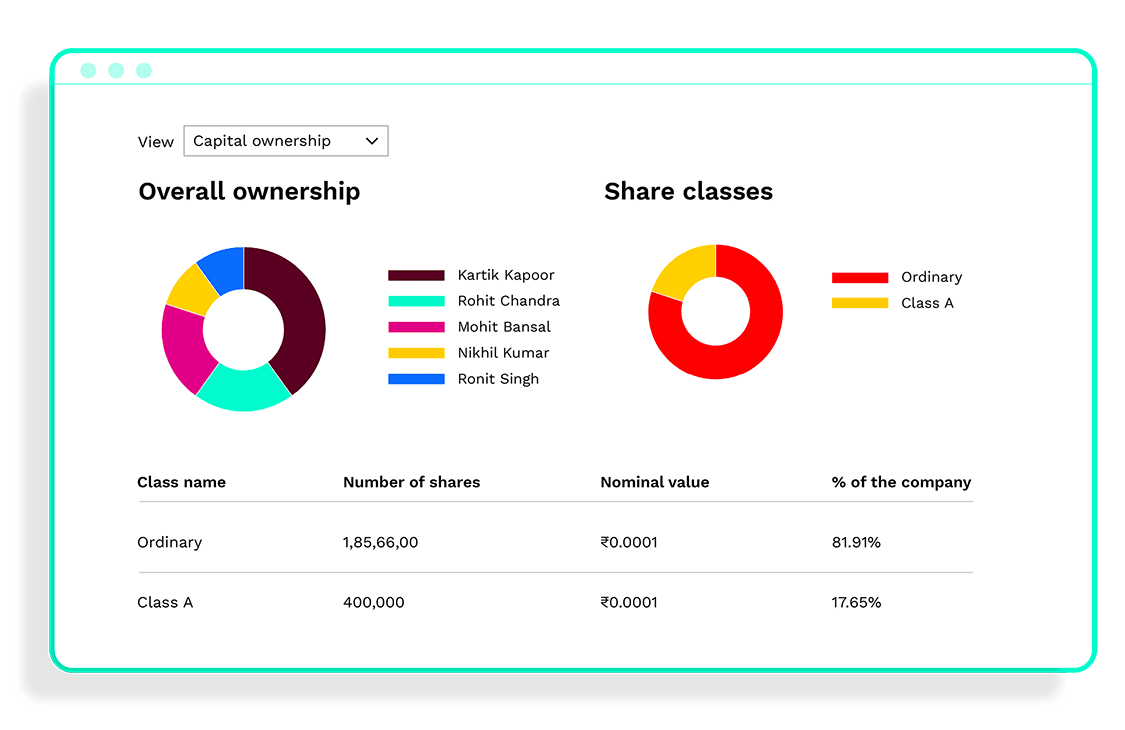

A capitalisation table (cap table or captable for short) details who has ownership in a company.

A good cap table clearly outlines who has shares, how many shares they have and the value of those shares.

It lists a company’s securities including shares, options and warrants, plus the prices paid by investors in return for any of those securities and details of dilution over time.

A cap table should also record vesting details - this is especially important for employee share option schemes.

Often, all of this critical info is contained in a spreadsheet. But as you'll soon discover, there's a far better way to maintain and update your cap table.

What's a pre-money cap table?

If you're talking to an investor, the chances are you'll hear the words 'pre-money' and 'post-money' when referring to a cap table.

It's pretty common for VCs and private investors to perform a pre-money valuation to determine the value of the company prior to investment.

And a post-money cap table?

Once the cash hits the bank, you can expect a post-money valuation which will determine the company's value after investment.

Pre-money and post-money cap tables offer two different views of a company's worth, and both can be reflected in your cap table.

Why is a cap table important?

If you're wondering whether you need a cap table, the answer is yes. Here's why your cap table matters:

1. Your cap table tells a story

A cap table, in a way, becomes a reflection of how well (or not so well) a company is doing in terms of growth and overall value.

A cap table tells the story of your journey so far. As time goes on and more shareholders come on board, your company's cap table will evolve too. Investors want to see that journey.

2. For complete clarity

When kept clean and tidy, a cap table provides a clear view of company ownership.

That clarity can help decision-makers make strategic decisions - like how much equity to set aside for future employees or potential investors. Plus with total visibility, shareholders can understand how their shares might dilute over time.

3. For fundraising

Securing investment for your startup can be a game changer, so you want to make a great impression, right?

A clean and tidy cap table is a shining example of attention to detail and due diligence - that you’ve got your house in order.

For investors, looking at a company’s cap table is like peeking under the bonnet of a car to see whether it’s a worthwhile investment or more trouble than it’s worth!

Ultimately, investors want to see how big a slice they could get in return for their cash investment.

And whether the size of the prize is worth the risk. To do so, they need to understand the company’s ownership structure before putting any money down. And a cap table is a great place to start.

4. For compliance

Different shareholders (particularly investors) often have different rights and privileges. A cap table should record whether a shareholder has voting rights and/or rights to dividends or other preferences.

That will determine who has a say in key commercial decisions. And what will happen following an exit or liquidation event - i.e. when shareholders can expect their returns to trickle back to them (AKA a waterfall).

A cap table can also play a key role in compliance checks ahead of any audits or funding rounds. And it's something that you can cross-reference with your shareholder register to ensure your records are accurate.

A shareholder register (AKA a register of members) is a legal requirement under the Companies Act. A cap table is not.

A shareholder register records all active and former owners of a company’s shares.

While it sounds similar, a shareholder register is not nearly as detailed as a cap table and there’s no requirement to include securities like convertible loan notes or warrants/

But directors are legally required to update HMRC of any material changes to the

company’s shareholder register.Among other things, your company is also required to file a confirmation statement every year - this is to tell Companies House that the information they have about your company's directors and shareholders is correct.

Do I have to share my cap table with investors?

No, you can keep your cap table confidential if you wish.

There's no legal obligation to share your company's cap table with anyone, that includes the Board of Directors, Companies House, employees and investors.

Arguably, all directors, investors and significant stakeholders should have access to your cap table. Potentially, any advisors, accountants or lawyers too. But whether employees should too is a hotly debated topic.

How to read a cap table

Every cap table will look different, but here's what you'll find in a (good) cap table:

- Name, address and contact details of each shareholder

- Authorised shares/options

- Outstanding shares/options

- The class and type of shares

- The nominal value of each share

- Details of any voting rights or rights to dividends

- Price per share

- Dilution details

- Any convertible loan notes, warrants or other securities.

As a general rule, if you come across a cap table that's not easy to read, it's not a great one.

Usually, in a cap table spreadsheet, you'll find shareholder names on the Y-axis and everything else on the X-axis, but there's no hard and fast rule.

How to create a cap table

Some founders are old-school and document everything including their cap table on paper. Not the sort of thing you want to misplace...

Other founders ask their lawyer or accountant to take care of their company's cap table for them, which could cost between £5-10k!

The most common way to create a cap table is in an Excel spreadsheet or a Google Sheet.

You can find examples and templates online of varying quality. Download our free Excel template, if you must (it's decent). But read on to find out why you shouldn't!

FREE DOWNLOAD

Cap table template

A spreadsheet template designed for non-complex companies.

✖️➗

Download

What's wrong with a spreadsheet?

While you could download it and be on your way, we wouldn't recommend using a spreadsheet to manage your cap table. Below are just a few reasons why.

1. Rounding errors

Nothing will stop your funding round quicker than an incorrect cap table. And a lot of the time, the main cause is rounding errors.

Spreadsheets are guilty of rounding figures, and while it may seem innocent enough, those pesky decimal places can come back to bite you later.

And it can be the difference between someone having a minor stake or a major stake in your company.

2. Human errors

You don't need us to tell you that you've got a lot on your plate.

As a company grows, keeping track of everything becomes a monumental task and equity is no exception. That cap table spreadsheet will only get bigger and more complex with different share classes, rights and preferences to contend with.

Everyone makes mistakes, but you really don't want mistakes in your cap table to cause headaches later on. Especially over something so silly as an extra digit or a filing mishap.

3. Missing information

Sometimes it's not incorrect data that's the problem, but rather a lack of information.

For example, failure to record the shares issued during an early friends and family funding round could mean that your company's ownership is not truly reflected at Companies House. Speaking of...

4. Discrepancies between company records and Companies House

A common mistake we see is directors filing a confirmation statement to Companies House and then assuming that means that the company’s shareholder records are also up-to-date...

...without completing the transfer instruments that actually make changes like that possible (and legal), e.g. stock transfer forms.

So your understanding of who owns what could be totally different to what Companies House understands it to be.

You need a single source of truth, not multiple sources saying conflicting things.

And if you take into account all the things that can go wrong in a spreadsheet, it's very easy for that to happen. If that does happen, you could find yourself in hot water from a compliance perspective.

Untangling messy spreadsheets takes time and money. But the thing is, this cap table pitfall is totally avoidable if you choose to use cap table management software instead.

How to update a cap table

You'll need to update your cap table anytime:

- Your company issues new shares/options

- Your company takes on investment

- Whenever other share movements like transfers occur

- Share options are exercised

An incorrect cap table can lead to complications. For instance, you might give away more equity than you bargained for or potentially mislead shareholders.

That last scenario could lead to more than just an awkward conversation at the Christmas party...

And as discussed, updating a cap table manually in a spreadsheet or on paper leaves room for risk. Vestd's virtual cap table updates automatically.

Cap table pitfalls (and how to avoid them)

If a cap table is inaccurate and impossible to understand, then it simply isn't fit for purpose. A broken cap table is a big red flag for investors. So what should you watch out for?

Signs that your cap table is broken

Here are a few things that eagle-eyed investors will pick up on:

- Inaccuracies - e.g. missing or out-of-date information.

- Dead equity - unaligned or uncommunicative shareholders with a significant stake.

- Toxic debt - missed loan/debt repayments including convertible loan notes.

- Fully diluted founder's shares - because where's the incentive to see it through?

Cap table mistakes to avoid

Now, this is by no means an exhaustive list but here are classic mistakes you don't want to make with your cap table:

- Giving too much equity away

- Not obtaining authorisation (and documentation) for share movements

- Not completing stock transfers

- Not recording vesting details in your cap table

- Not issuing options without a defensible fair market value

- Not accounting for option expenses

- Miscommunicating the value of shares/options

- Not structuring waterfalls correctly

Some of these mistakes are simple to solve, others aren't so easy. In most cases, prevention is better than a cure.

We explore all of the above and more in-depth in our ultimate guide to cap table management which you can download for free.

FREE DOWNLOAD

The Cap Table Management Guide

Everything you need to know about cap tables in one place.

Get the guide

The cost of a broken cap table

Can you put a price on peace of mind? Perhaps not. But a cap table in chaos could cost you the cash injection your startup needs to succeed.

It could take hours of an accountant's or a lawyer's time to rectify any errors (and cost a pretty penny).

££££ can be spent repairing a broken cap table.

And furthermore, you could accidentally end up with not enough skin in the game meaning your exit (if you intend to move on) may not be as fruitful as you hope.

Cap table management software saves the day

All things considered, the obvious solution to avoid cap table chaos is a cap table management platform. With Vestd, you can ditch the spreadsheet once and for all and manage your cap table (and equity in general) entirely on the platform.

No chaos, just a clean and tidy cap table.

Give your cap table the love and attention it deserves. Use Vestd.

FREE CAP TABLE

Explore our Free Plan

Get your free digital cap table today and unlock more features as you scale!

Join Vestd

Frequently asked questions

-

What is a cap table?

A cap table is a document that shows who owns what in your company. Unlike your statutory shareholder register (which is a legal requirement in the UK), the cap table is more of a management tool that helps founders and investors see the bigger picture.

-

What information does a cap table include?

A cap table typically shows:

-

Names of shareholders

-

Types and classes of shares

-

Number of shares owned

-

Percentage ownership

-

Details of options, warrants, or convertible instruments

Some also include a “fully diluted” view, which factors in all potential future shares.

-

-

Is a cap table legally required in the UK?

No, UK companies are only legally required to maintain a register of members (the official shareholder register). However, a cap table is considered best practice and is almost always expected by investors during fundraising.

-

How does dilution work and how will it affect my ownership?

Dilution happens when new shares are issued (e.g. to raise investment or grant employee options). This reduces the percentage ownership of existing shareholders, even if their absolute number of shares doesn’t change. A cap table makes dilution transparent.

-

What is a fully diluted cap table?

A fully diluted cap table shows ownership as if all outstanding options, warrants, and convertible instruments were exercised. Investors often ask for this view to understand the “worst-case” dilution of their stake. Dilution isn't something to lose sleep over though - learn more.

-

How should I treat convertible instruments?

Convertible instruments (like SAFEs or convertible loan notes) aren’t always included on the live cap table, but they should be modelled to show the impact if and when they convert. This helps avoid nasty surprises when a round closes or debt converts to equity.

-

When should I create a cap table?

The best time is day one! While startups sometimes skip it, retrofitting a cap table later can be messy. Starting early makes it easier to track ownership changes, avoid errors, and be investor-ready.

-

How often should I update my cap table?

Any time ownership changes. That includes new share issues, transfers, option grants, conversions, or buybacks. A regularly updated cap table saves headaches at funding rounds and during due diligence.

-

How do investors view a cap table during due diligence?

Investors want clarity and confidence. They’ll be looking for clean ownership records, sensible option pools, and no “dead equity” hanging around. A messy cap table is a red flag.

-

What is dead equity and how should I handle it?

Dead equity refers to shares held by people who no longer meaningfully contribute to the business. Learn more.

-

Do I need to share my cap table publicly or with Companies House?

No, you don't need to. Your statutory shareholder register is filed at Companies House, but your cap table is primarily for your benefit and to satisfy key stakeholders' or investors' interests.

-

Can I manage a cap table in Excel or a Google Sheet, or should I use software?

A spreadsheet can work in the very early days, but it quickly becomes error-prone as your business grows. A cap table management platform like Vestd reduces risk and improves visibility!

3 min read

Why investors hate messy cap tables (and how RUVs can help)

Luke Richards: Oct 28, 2025

2 min read

Nominee vs beneficial owner: Understanding legal ownership

Luke Richards: Oct 27, 2025