Why grant options over existing shares?

Equity dilution, share dilution (or whatever you want to call it) is not inherently a bad thing. Not if it’s well managed.

Manage your equity and shareholders

Share schemes & options

Equity management

Migrate to Vestd

Company valuations

Fundraising

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

6 min read

Simon Telling

:

Updated on October 1, 2024

Simon Telling

:

Updated on October 1, 2024

Last updated: 16 April 2024

Whether you already have an employee share option plan or are considering launching one, equity dilution is likely a topic at the front of your mind.

It’s natural to worry about how dilution affects your team. You want to make sure that you have enough equity to share with everyone, and that everyone gets their fair portion of what you’ve built together.

But the subject of dilution doesn’t need to keep you up at night.

If you can gain a solid understanding of what dilution is, when it’s most likely to occur, and the questions you need to ask yourself before granting options, you’ll be able to make smart decisions about equity.

After reading this post, it’s our hope that you’ll view dilution as a natural occurrence and can focus instead on growing the value of your business. And in turn, growing the value of your shares for your team.

Let’s explore the topic of dilution in-depth, beginning with an explanation of what dilution actually is and how it might occur at a business like yours.

When you start your business, you and any co-founders you might have are the only ones with equity. You own the company and take home all of its profits.

If you award equity to investors in exchange for an investment in your business or start a share scheme to grant options to your employees, the amount of equity your founding team has will be reduced (at the time of exercise, in the case of options).

Each additional time that equity is awarded to new investors, future hires, and so on, this will again reduce the portion of equity that everyone ultimately receives (but not necessarily its value, which we’ll discuss shortly).

Dilution is the reduction of each shareholder’s proportion of equity as the result of additional equity being issued.

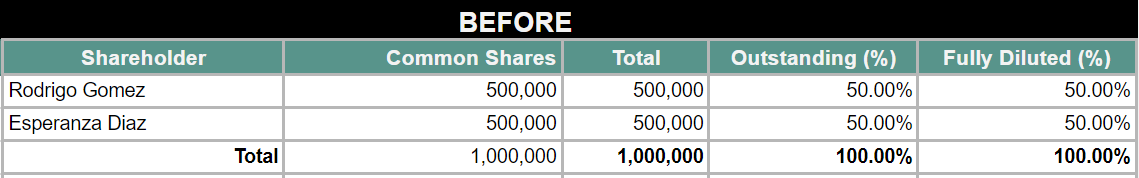

One thing you must be aware of is that the issuance of any new equity results in the eventual dilution of all shares at the time of exercise. For example, let’s consider a company with two equal co-founders:

They are ready to take on their first investor. By awarding 100,000 shares to an investor, both of the founders’ shares will be reduced by 10%:

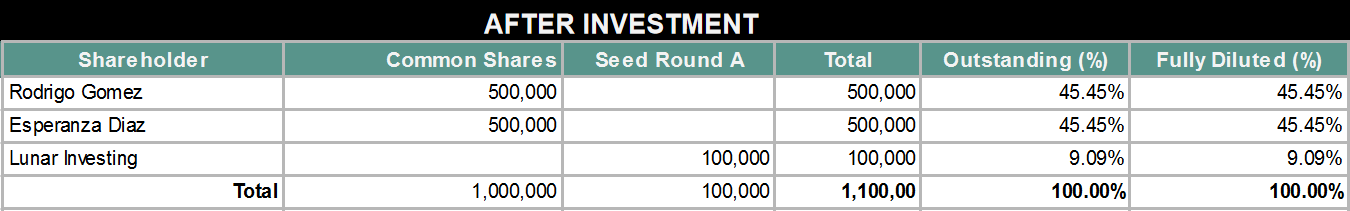

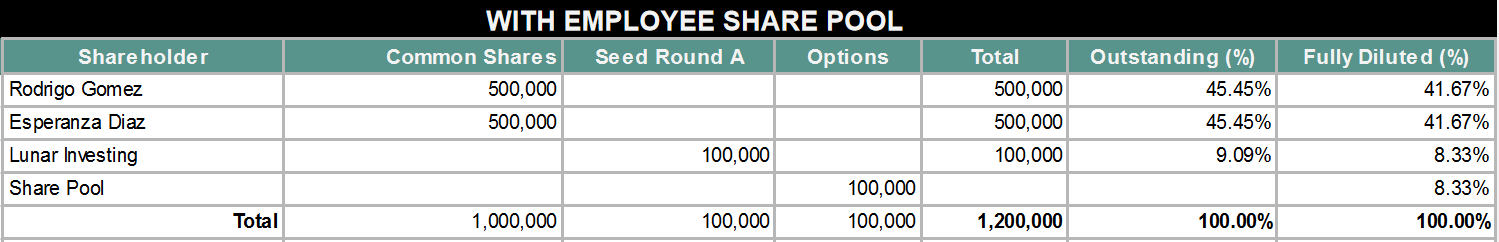

If a company share scheme is then established with a pool of 100,000 new shares, that will reduce all the shareholders’ equity at the time of exercise. This is reflected in the “fully diluted” column (far right):

As these examples demonstrate, as your business awards more equity, the amount of future exercised shares is potentially reduced for shareholders.

Significant equity dilution in companies operating a share options scheme typically occurs for one of three reasons:

Let’s take a look at how a sample company’s equity might become diluted over time as these three events occur.

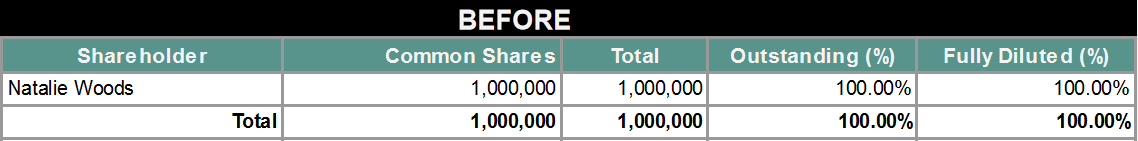

Our sample company begins with a single founder holding 100% of the equity:

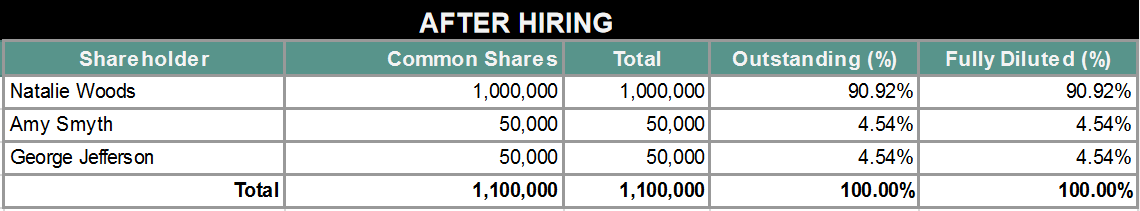

Say our founder makes two critical hires, and in lieu of market-rate compensation, awards each individual with 50,000 common shares. This reduces the founder’s equity (at the time of exercise) from 100% to about 90%.

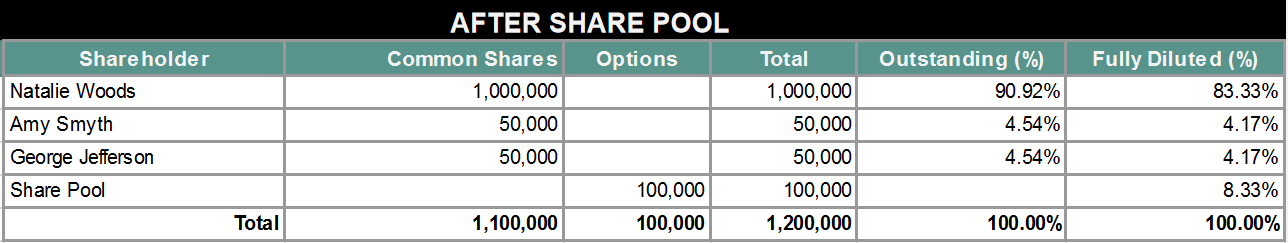

Months later, as hiring increases, our founder decides to create a new pool of 100,000 shares to use for an EMI scheme.

Although the effect of this dilution will not be felt until employees exercise their options in several years, you will still see that our owner’s fully diluted equity percentage will drop to 83% at this point, and the two early hires’ fall from 5% to just above 4%.

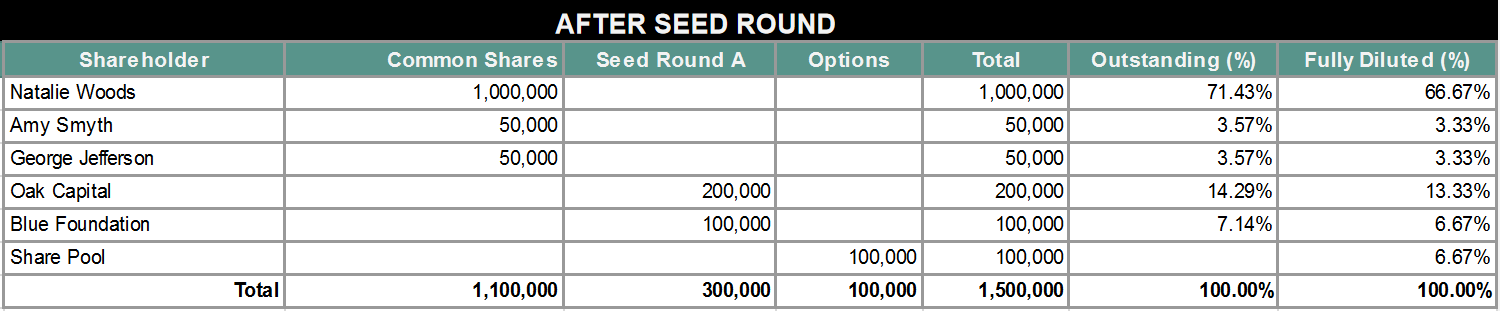

Finally, sometime later, our founder holds their first round of fundraising. They take on two investors and give them 200,000 and 100,000 shares in return, respectively (representing roughly a 14% and a 7% stake in the company).

By doing so, our founder’s fully diluted stake has been reduced to just over 66% in just a few short steps.

With these examples, you can see just how quickly dilution might occur as businesses begin granting options to their team or awarding shares to investors.

Seeing how pervasive dilution can become, you might be worried about the effect of dilution on the eventual fully vested shares granted to your team.

You should be mindful of the potential impact of dilution on the exercised value of your company’s shares. However, how much you should think about this impact largely depends on what stage of growth your company is in:

Let’s take a closer look at how these two different stages of growth might change your opinion of dilution.

While it’s certainly important to be aware of how much equity you’ve awarded (and to whom) and to track how this equity is diluted over time, at this early stage of growth, you should only be concerned with percentages if they may affect your company’s control and voting.

At this point, because you are likely to have so few names in your cap table, dilution will impact your team far less than you might expect.

The only exception would be if your issued options might impact the percentages required for ordinary (51%) and Special (75%) resolutions.

If your business is growing its monthly and annual revenue (MRR/ARR), doing a good job of retaining customers and/or subscribers, and increasing its profits, you should also see your company valuation increase over time.

An increase in valuation means an increase in the value of each share that your team will hold after vesting (or completion of an exit if the options are exit-based).

The number of shares awarded is important, but the value of those shares at the time of exercise matters much more.

This also applies to the shares held by you and your founding team: although dilution might reduce your stake from 50% to 40% over time, the value of that equity should rise.

And owning 40% of a successful company is likely worth much more than owning half of one with an uncertain future that comes without great contributions from your team.

As you continue to grow, you can make smart decisions to maximise your team’s final exercised value of shares. As you continue to award equity, be mindful of the following:

Each time a new grant is made, your cap table should be promptly updated with both the current and fully diluted equity percentages for each shareholder. If you are using Vestd, your cap table will be kept current for you.

Your company should establish an equity “pool” for its share scheme, then use either the Wealthfront or Wilson method described in this post to calculate the number of shares to award.

If you have a shareholder that has close to 5% equity (and therefore should benefit from Business Asset Disposal Relief on their Capital Gains Tax) when they eventually sell their shares, the issuance of new shares or options may push them below the 5% threshold.

If you are mindful of the three items above, you will not have to worry very much about dilution.

Instead, focus your efforts on growing your revenue and retaining customers, as this will cause your valuation to rise, and that is where you will see the biggest impact long-term.

Once you are ready to accept external investments in exchange for equity, you will need to think a little more carefully about dilution and its potential impact on your team.

Much like we’ve discussed above, the value of shares at the time of exercise is what is most important, not so much what percentage of the company each shareholder possesses.

However, if you take away too much equity at once, this may have a dramatic impact on that value.

For example: if dilution reduces a co-founder’s stake from 50% to 45%, but the company valuation increases from £1M to £3M in the two years following, the value of their shares is more than it was when they held 50%.

But if their stake is diluted all the way down to 10%, it would take more than a £3M valuation to make up this loss in value. The co-founder might need to wait several years before seeing the value of their equity fully recovered.

This effect may be less dramatic for individual team members, who will be granted a number of options and not percentage stakes of ownership.

But a large loss in overall equity can still have an effect on the value of the total employee share pool.

If you are considering taking on external funding, you should ask yourself these important questions about equity first:

Dilution of equity will likely occur over the lifetime of your business, but with the right choices, it won’t change the value of what you and your team have built together.

If your valuation grows, the value of the options you’ve granted will grow as well, and this will help negate the effect of natural dilution.

Looking to learn more about employee share option schemes? Read our complete guide to employee share schemes, it'll tell you everything you and your team need to know.

And, when you're ready, book a free consultation with one of our equity specialists who will show you how straightforward share scheme and equity management can be.

Equity dilution, share dilution (or whatever you want to call it) is not inherently a bad thing. Not if it’s well managed.

Pre-emption rights may sound perplexing, but they serve a simple yet critical purpose: to protect shareholders’ ownership stakes when a company...

Last updated: 19 April 2024