Guided scheme design

Vestd provides UK companies with a fully guided service for share and option schemes. You’ll always get five star support. Get started by booking a free consultation.

Manage your equity and shareholders

Share schemes & options

Fundraising

Equity management

Start a business

Company valuations

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

Book a demo

There are no statutory requirements or limits to abide by so these options can be granted very quickly.

✓ Ideal for non-employees

✓ All sorts of conditions can be set

✓ Can be used internationally

There are more tax efficient ways to give people skin in the game but unapproved options are about as flexible as it gets.

✓ Don’t need a formal valuation for HMRC

✓ Can be granted below market value

✓ Cost of the scheme can be offset

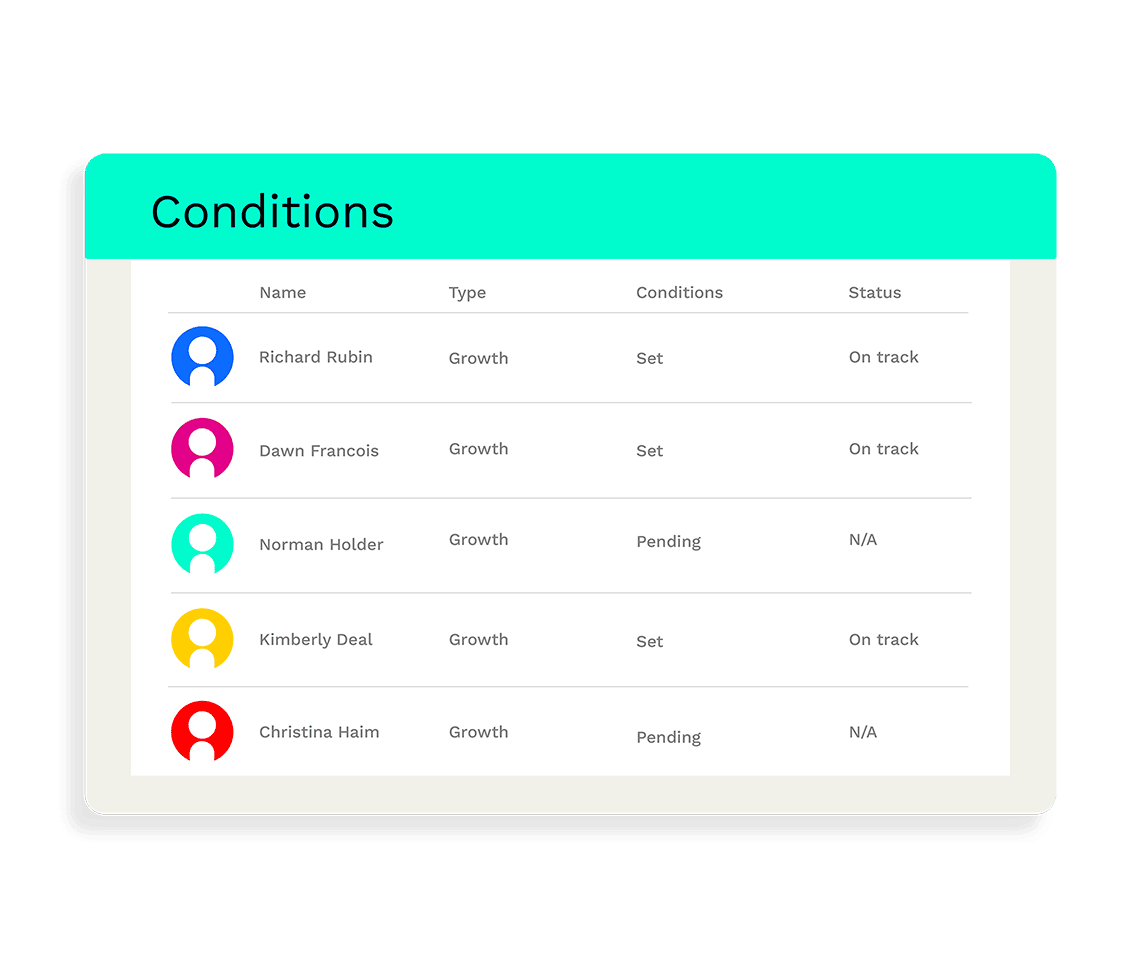

You can set conditions for recipients, such as achieving milestones, or staying with the company for an agreed period of time. We’ll help you figure out the best conditions - what’s most important is that the criteria is clear and not subjective.

Vestd provides UK companies with a fully guided service for share and option schemes. You’ll always get five star support. Get started by booking a free consultation.

You don’t need a valuation but it can be useful to get one for a number of reasons (see FAQ below). We will provide you with an up-to-date, defensible valuation as part of the service.

You can use the Vestd articles of association for free in the event that your articles don’t have the right drag and tag provisions in place (to ensure that dilution and exits are handled correctly).

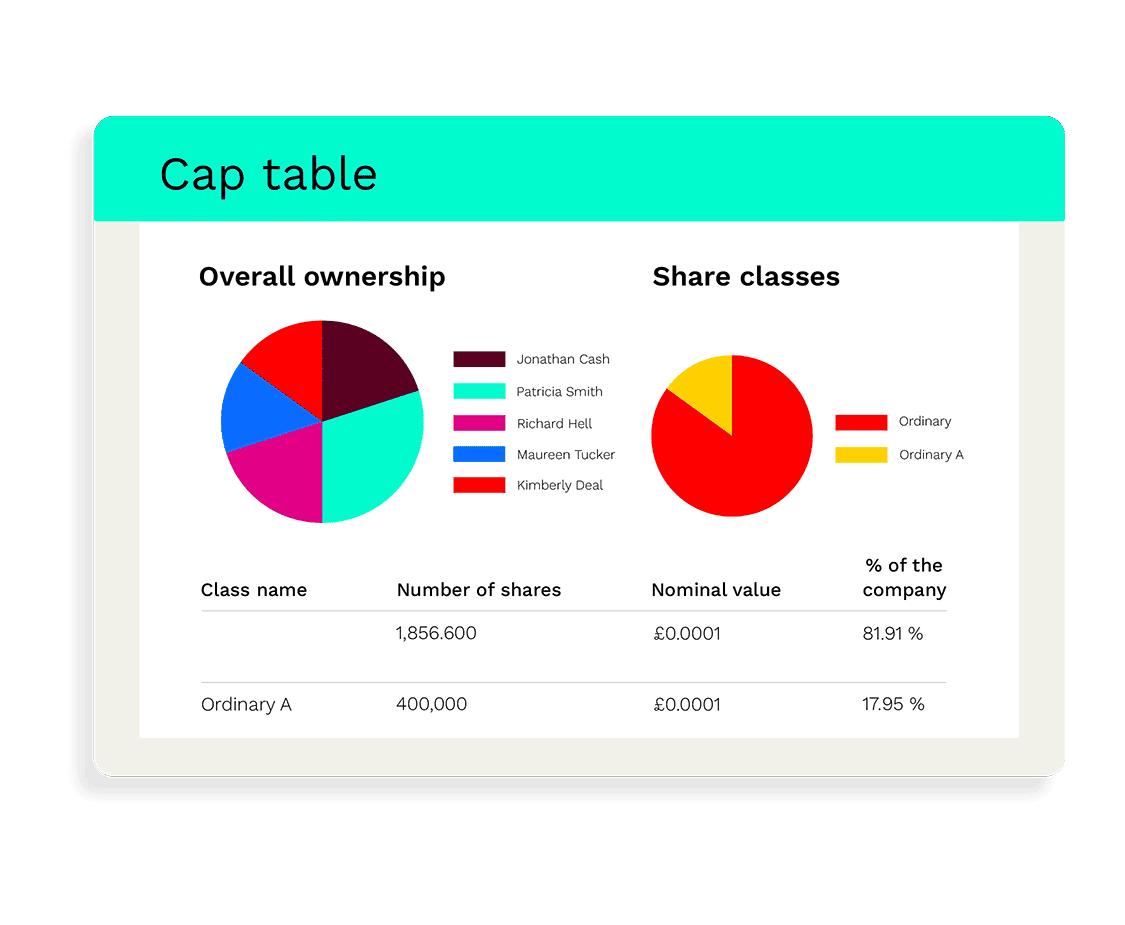

Total equity management: the only platform with two-way Companies House integration and a real-time digital cap table.

Guided setup and support: our team of 60+ equity specialists are on standby to help you.

Company valuations provided: there's no need to ask your accountant for help.

Custom terms and conditions: you can design individual agreements for each team member. We're big on 'conditional equity'.

FCA authorised & regulated: our competitors don't seem to think this matters, but we do.

The platform itself allows you to manage all aspects of share and option management concisely in one place. The automations and integrations save you time. But while the platform is great, it is the team that makes Vestd stand out. From pre-sales to onboarding and the ever-helpful support team - not only do they support on the platform but provide excellent knowledge in this area.

Great platform. The team always provide brilliant support. I would definitely recommend using Vestd to anyone who needs to set up and administer an EMI scheme.

Straight forward and structured approach - so good for founders and also FD/CFO/advisor who is looking to get share capital and share option schemes in place.

A fantastic platform. The price is fixed. The customer support is fantastic and readily available. They have held our hand right through the whole process.

I love Vestd and I wish I had found it sooner. It makes the whole process of issuing shares whether they're growth shares or ordinary shares incredibly simple.

Amazing shift from Excel to Vestd. The support team were amazing and did a great job of completing our setup and we have been very pleased at being able to better manage our governance over time.

Thinking about whether unapproved options are the right choice for you?

We'll help you understand the second-degree implications and how to design a share scheme in next to no time. Calls are totally free and there's no obligation to use Vestd afterwards.

Unapproved share options are flexible and can be given to employees, contractors, advisors, consultants and international employees. These options don’t require any formal valuation or notification to HMRC when the options are set up (unlike EMI), although they do need to be included in an annual report to HMRC if they have been given to UK employees or directors.

There is however no tax benefit for the recipient, who is liable for Income Tax on the difference between the exercise price and the market value of the shares at the time they are exercised.

An employee may also be liable to pay National Insurance on this sum if the unapproved shares are readily convertible to cash at the point of exercise (in a sale scenario, for example). International employees will be subject to tax in their tax authority.

For UK recipients who aren't employees, there is also a potential tax liability on grant of option (VAT) to the extent that the exercise price is below the market value at date of grant.

Whilst there is no approved valuation for unapproved share options, it can be useful to get a valuation for a number of reasons.

1. Employees or directors: employees or directors can be granted options below market value with no tax consequence, so you don't need to know the value of your company at grant. However, you do have to submit the value of your business at the point of grant during your annual notification.

2. For UK non-employees or companies: there is a potential VAT tax liability if options are granted below market value, so the valuation becomes important to inform the recipients of any potential tax liability.

3. For international employees: in some countries, there is a tax liability for options on grant, so again, it may be useful to know the tax point for your international recipients (in the US, for example, it is important to get a Section 409A valuation, as the grant of options does potentially create a tax liability).

For UK employees or directors, in cases where these unapproved shares are not readily convertible into cash, only income tax (and not NI) is due and declared in the recipient's self-assessment tax return for the tax year in which the option is exercised.

For non-employees who have been issued options below market value, there will be an additional VAT to pay on the difference between the exercise price and the market value at award and then income tax or corporation tax on the gain at exercise. For international recipients, it will be determined by their local tax authority.

This can be any price but typically a price you and the recipient would feel is fair given the current status of the business. Or a lower price if you want to pass the maximum amount of value to the recipient. This is a commercial decision for the business and will depend on specific circumstances (speak to one of our share scheme specialists about this).

Almost, you could give shares to someone at today’s nominal value which could be an extremely low value. That would mean they pay you next to nothing for the shares and pay income tax on the whole value at the point they exercise them (and become the legal owner of the shares).

Once an employee has exercised their shares, they become a legal shareholder and buybacks will work in accordance with your articles. This almost always gives the existing shareholders first rights. There is no open market for Ltd company shares to be traded on.

If you have standard ‘model’ articles then yes, in most cases these are sufficient for issuing ‘exit only’ unapproved options. If however, you’d like to issue options that are exercisable before an exit event then you should ensure your articles include ‘drag and tag’ provisions. If you don’t have these you can use the Vestd articles for free which include this.

Each unapproved share option award can include a unique and specific set of qualifying criteria. This could be as simple as ‘turn up each day’ or more specific and linked to key milestones like helping the business meet specific targets. What’s most important is that the criteria is clear and not subjective.

Typically, when businesses use vesting schedules they set a years cliff (i.e. no shares can vest until after the first 12 months) and then the shares vest proportionally over a 3-5 year period.

Some businesses like to get creative and front or back load the vesting and others like to increase the vesting frequency to quarterly or monthly (all of this is simple to create and manage using Vestd).

The choices are either ‘on exit’ or after they have vested, up to the end of any defined exercise period. Based on our latest data, 62% of companies opt for an ‘on exit’ scheme, with the remaining 38% setting a specific time depending on their rationale and objectives for sharing ownership.

Depending on your situation you might also want to consider EMI options or growth shares as unapproved options tend to be the least tax-efficient for the recipient. Speak to one of our specialists (for free) to better understand what might be best for your situation.

Typically you would either set the exercise price at the value of the shares at the time of issuance, or at their nominal value (the lowest possible price). This is a commercial decision for the business and will depend on specific circumstances. Book a call to get some free insight on how other companies typically do this.

Approved share options, such as EMI schemes, come with specific tax advantages and eligibility criteria. Unapproved share options are more flexible, with fewer restrictions, and can be granted to employees and non-employees, including international team members. Vestd can help you decide which is right for your business.

EMI options are a type of tax-advantaged share option granted to employees as part of an Enterprise Management Incentive scheme. They give team members the right to acquire shares in the company at a set price in the future.