FUND YOUR VISION

The Seed Enterprise Investment Scheme

Help those who help you. Reward investors for their cash injection with generous tax reliefs. Learn about SEIS for early-stage startups.

Manage your equity and shareholders

Share schemes & options

Fundraising

Equity management

Start a business

Company valuations

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

FUND YOUR VISION

Help those who help you. Reward investors for their cash injection with generous tax reliefs. Learn about SEIS for early-stage startups.

GROW YOUR BUSINESS

Get the funds you need to take your startup to the next level, with no repayments in the short to medium term. Learn about EIS for small businesses.

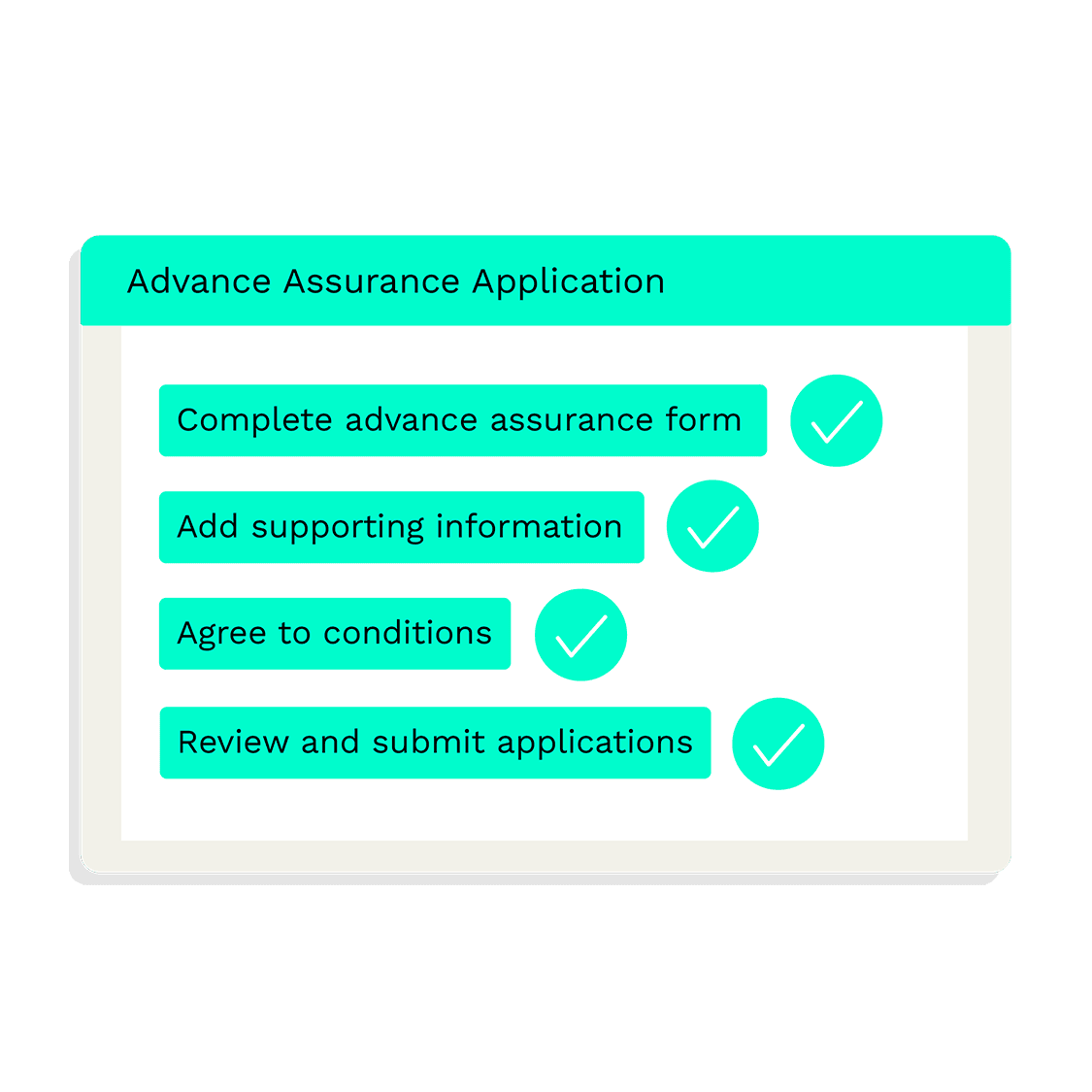

GUIDED WORKFLOW

We've created the most founder-friendly application for SEIS/EIS advance assurance.

We provide expert guidance every step of the way, so you know you're on the right track.

.png?width=2250&height=1619&name=Eligibility%20Checker%20(1).png)

END-TO-END APPLICATION

Apply for advance assurance and submit compliance statements—all on the app.

Fill in the fields, upload your docs, and we’ll handle the rest with HMRC.

Save time, avoid hassle, and we will ensure nothing gets missed for the best chance of success!

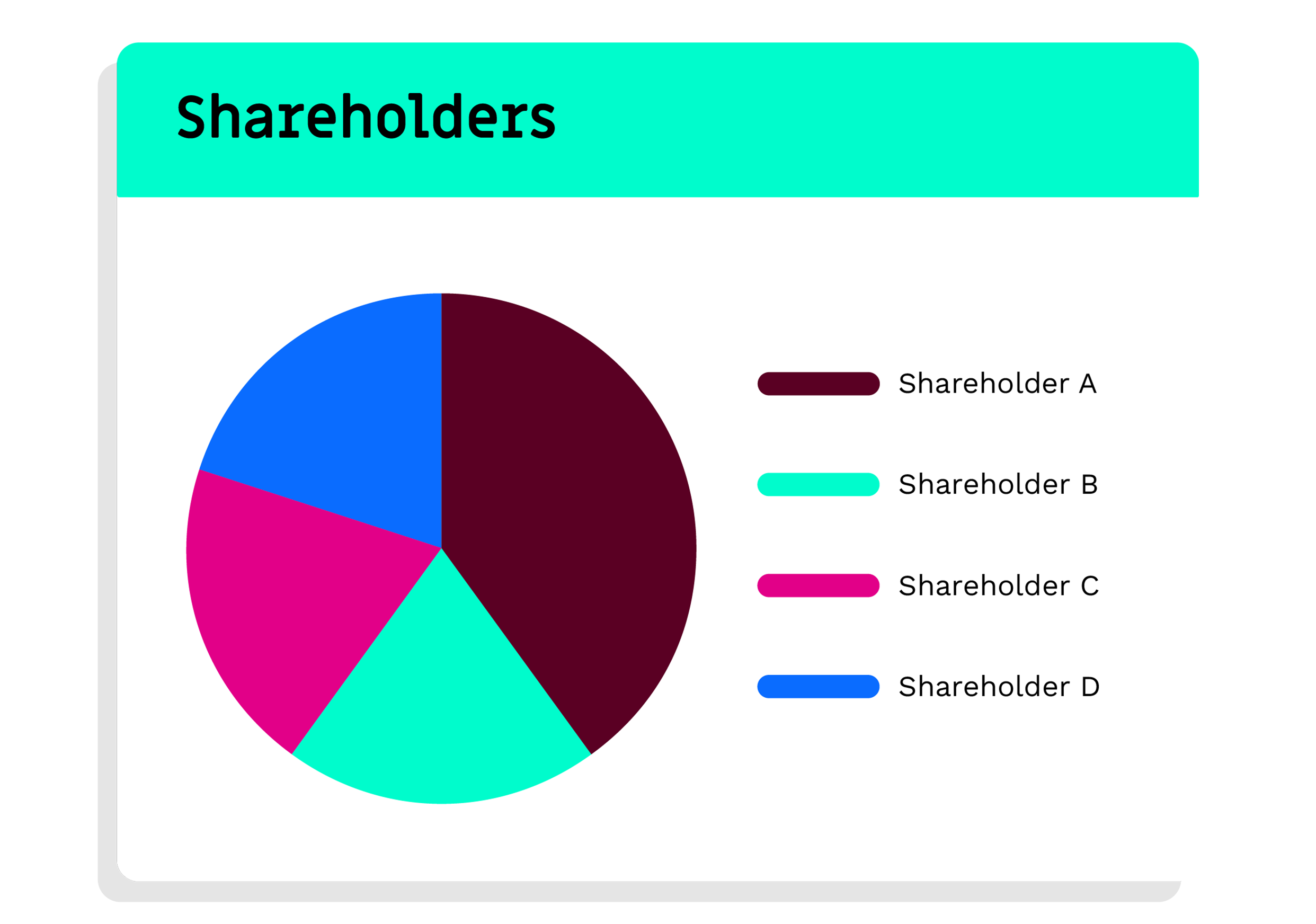

EQUITY MANAGEMENT

Once you've received investment through SEIS or EIS, you can issue shares and share certificates to investors directly through the platform.

Get a clear view of your company ownership with a digital cap table that updates automatically.

See if your business ticks the right boxes before you start.

Apply for SEIS/EIS advance assurance with complete confidence.

Become immediately more investable with SEIS/EIS advance assurance.

Easily upload (and store) your business plan and more.

Ideas on how to put SEIS/EIS investment to good use to grow your business.

Issue SEIS/EIS shares and share certificates to investors with ease.

The platform itself allows you to manage all aspects of share and option management concisely in one place. The automations and integrations save you time. But while the platform is great, it is the team that makes Vestd stand out. From pre-sales to onboarding and the ever-helpful support team - not only do they support on the platform but provide excellent knowledge in this area.

Great platform. The team always provide brilliant support. I would definitely recommend using Vestd to anyone who needs to set up and administer an EMI scheme.

Straight forward and structured approach - so good for founders and also FD/CFO/advisor who is looking to get share capital and share option schemes in place.

A fantastic platform. The price is fixed. The customer support is fantastic and readily available. They have held our hand right through the whole process.

I love Vestd and I wish I had found it sooner. It makes the whole process of issuing shares whether they're growth shares or ordinary shares incredibly simple.

Amazing shift from Excel to Vestd. The support team were amazing and did a great job of completing our setup and we have been very pleased at being able to better manage our governance over time.

We'd love to learn about your business and goals, and demonstrate how our platform will transform the way you share, manage and track ownership.

No, but companies with advance assurance stand a better chance of getting the investment they need.

Advance assurance is HMRC’s way of checking whether your company meets the conditions of SEIS and EIS and whether the investment itself will qualify for tax reliefs.

As such, many investors will only invest in companies that have received advance assurance. Learn more.

SEIS/EIS advance assurance applications can take up to 8 weeks for HMRC to approve. However, most simple applications can be turned around in as little as 3-4 weeks.

The key difference is that SEIS is designed to help very-early stage businesses, whereas EIS is for businesses that have been trading for a little longer. Learn more.

Vestd customers can check whether their company is eligible for EIS and SEIS on the app before applying for advance assurance. Otherwise, click here to view the eligibility criteria for EIS or here for SEIS.

Yes, but only if you raise funds with the SEIS first. Your company can't issue shares under EIS, and then go back and issue shares under SEIS.

If you’re already a Vestd customer, log in to your account and go to 'SEIS/EIS' to start your advance assurance application. If you'd like to join Vestd, book a free consultation with our team today.