| Guided | Self-Serve | Essentials | |

|---|---|---|---|

| Equity management | |||

| Two-way Companies House integration We automatically file documents with Companies House when required We’re also the only platform that pulls data from Companies House, which saves time when joining. Learn more. |

|||

| Company incorporation Our guided workflow lets you incorporate a new company, create ordinary share classes, add directors and shareholders, and split the share capital. We’ll then send everything to Companies House. |

|||

| Articles of Association Articles of Association govern a company's internal affairs and management. We offer articles support with Companies House filings, and you can adopt the Vestd Articles for the ability to issue growth shares. Learn more. |

|||

| Issue shares Issue shares directly to new and existing shareholders and Vestd will take care of Companies House filings and generate share certificates for you to issue. |

|||

| Share certificates (branded) All share issuances come with a share certificate for the shareholder. You can even customise them with your branding. |

|||

| Share authorisations Automatically send the required resolutions to directors and shareholders to gain the authorisation to issue shares, options and growth shares. |

|||

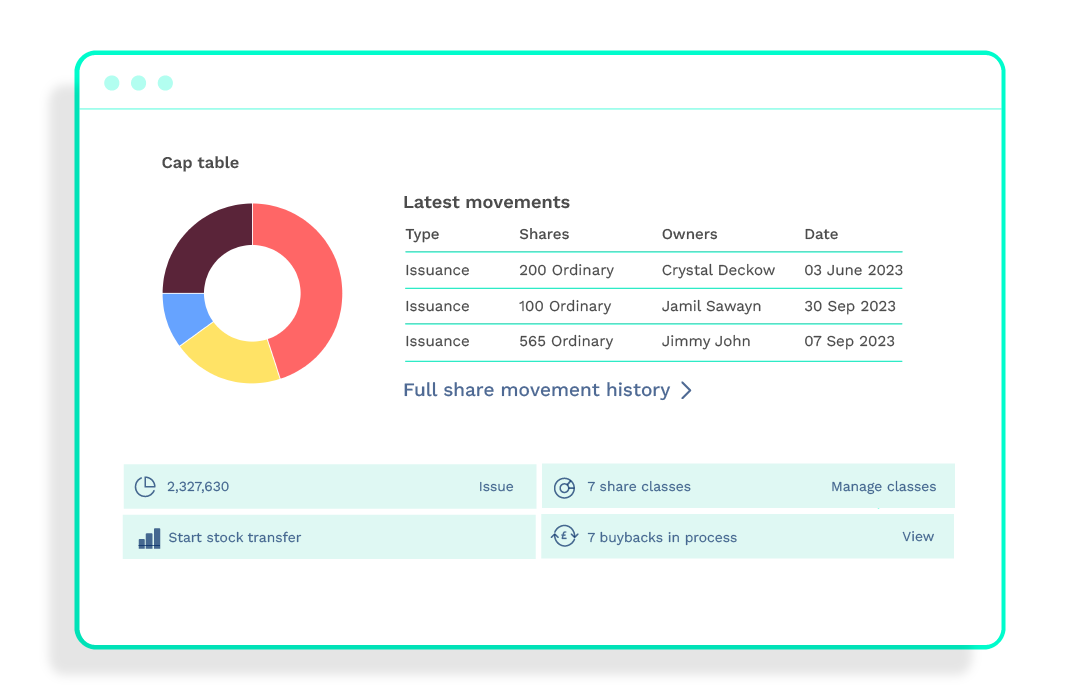

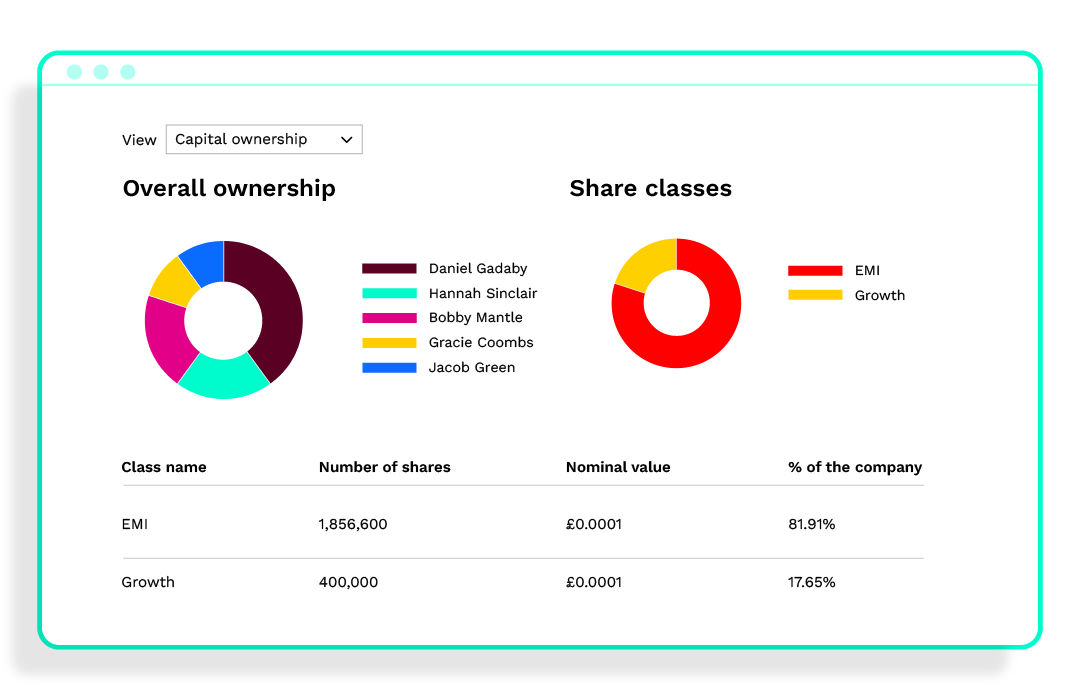

| Digital cap table Whenever any share capital activity takes place on Vestd, your digital cap table will be automatically updated accordingly. You can also simulate different views and download the data for investors. |

|||

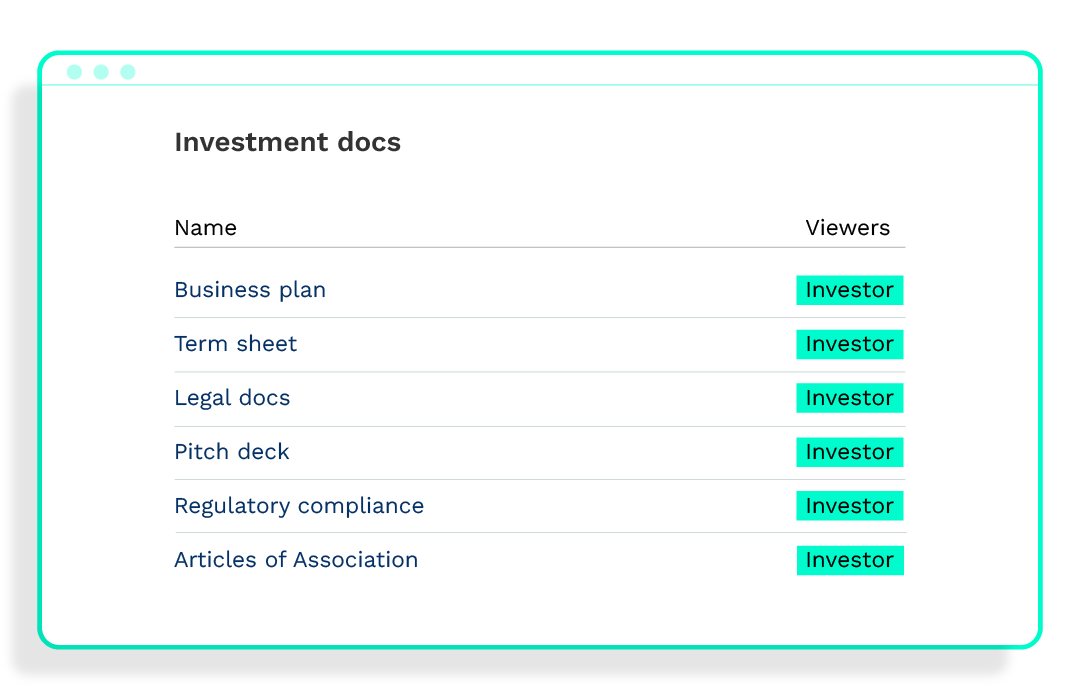

| Secure data room Upload documents, financial reports and investor prospectus to share with key stakeholders. Only those invited to each room will have access. |

|||

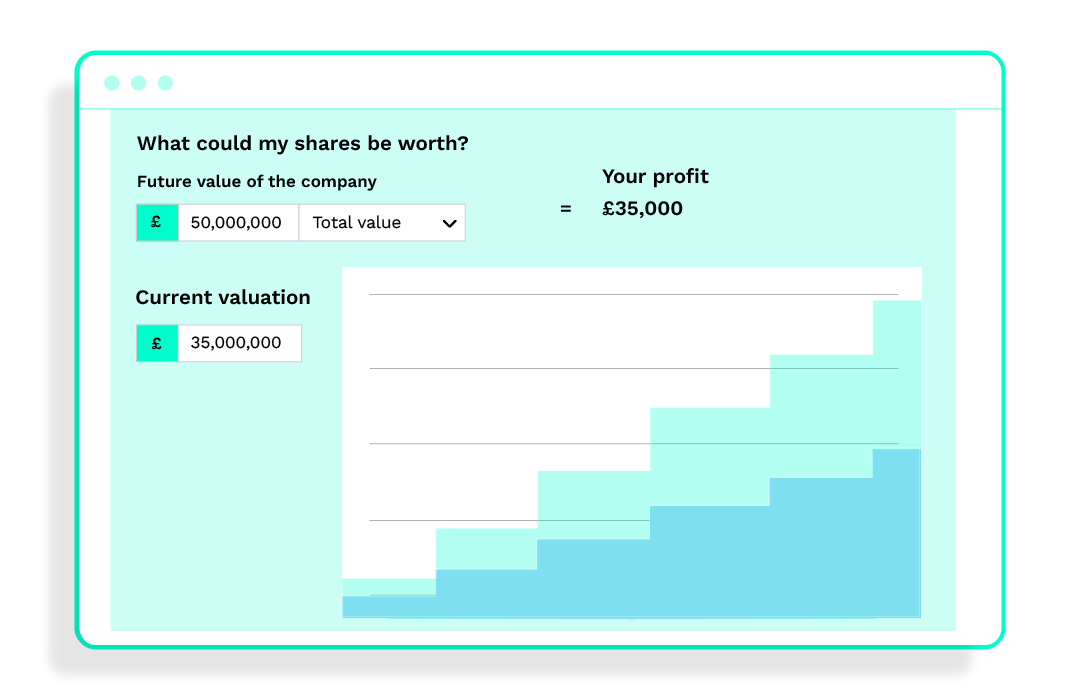

| Scenario modelling Use our modelling tools and calculators to see how your share capital will look after investment rounds, option grants and other scenarios. In some cases this will require a share movement History upload process in order to model future value. |

|||

| Shareholder dashboards All shareholders and option holders invited to Vestd get their own dashboard where they can project the current and future value of their equity. Handy tax calculators show their potential profit too. |

|||

| Business & legal documents We provide complimentary document templates such as Advance Subscription Agreements, NDAs and Shareholders’ Agreements to help you streamline business procedures. |

|||

| Company secretarial tools All resolutions, confirmation statements and other company governance documents are stored on Vestd and sent to Companies House when required, making Co-Sec tasks much easier and virtually paperwork free. |

|||

| Shareholder register Vestd can be used as your legal shareholder register, granted all shareholders’ addresses are added and all share movement history is uploaded. Please note that only transactions made since joining the platform will have accurate dates. A share movement history upload may be required in some cases. |

|||

| Confirmation Statements Confirmation statements need to be submitted to Companies House each year. Vestd does pretty much all of it for you – we even pay the filing fee! |

|||

| Digital signing All resolutions and other documents generated by the platform can be digitally signed via DocuSign. No printing, no faff. You can also upload your own documents for signing (up to the monthly limit). |

|||

| Subdivide existing shares Subdivisions (or share splits) create more shares in the company without diluting existing shareholders, making your share capital easier to distribute. Our subdivision tool basically does it all for you, answer a few questions and you’re done. |

|||

| Board and shareholder resolutions When board/shareholder authorisation is needed, Vestd automatically generates the resolution and sends it to the appropriate people to sign, then files it with Companies House. You can also create bespoke resolutions for other business matters. |

|||

| Add & change director details Any changes to your company’s directors are automatically filed with Companies House. |

|||

| Change the company name Company name changes are automatically filed with Companies House. |

|||

| Update PSCs | |||

| Stock transfers A stock transfer is used to manage the sale or gifting of shares between shareholders. Vestd generates the Share Purchase Agreement and Stock Transfer Form for the relevant people to sign, then updates Companies House. |

|||

| Share buybacks Companies can buy back shares from shareholders via Vestd, and we’ll update Companies House with the required paperwork and let you know whether Stamp Duty is due. |

|||

| New share classes You can create additional share classes for investment rounds or share schemes. Vestd takes out all the guesswork and files the required documents with Companies House. |

|||

| SEIS/EIS advance assurance SEIS/EIS advance assurance makes your business more attractive to investors. Apply through Vestd and take out all the guesswork. Learn more. |

|||

| Share schemes | |||

| Company valuations (per year) Our in-house Valuation team provides valuations to ensure maximum tax certainty for your option holders. |

|||

| Share scheme design Answer a few simple questions in guided workflow and create a bespoke share scheme that aligns with your company’s goals. |

|||

| Share scheme legal docs You can use Vestd’s agreements for your option and growth share schemes. Each agreement is customised to the unique needs and goals of each share scheme. |

|||

| Guided scheme design Our Customer Success team can help you design a share scheme based on your company’s goals. |

|||

| HMRC notification support We’ll help you file the notifications to HMRC to keep your share schemes compliant. |

|||

| Conditional equity Set time or performance-based conditions people must meet to earn their equity. |

|||

| Co-founder vesting Co-founder vesting schedules reward people for what they deliver while protecting them when someone fails to deliver. |

|||

| Co-founder prenups Also known as an Agile Partnership. It aligns founders with key targets they must meet to earn their equity and ensures everyone’s best interests are protected. |

|||

| Initial equity consultation Discuss your business goals with our Equity Consultants and they’ll recommend the best conditions to add to your share schemes to achieve them. |

|||

| Second equity consultation A deeper dive into your company and its share capital. |

|||

| Scheme types | |||

| Enterprise Management Incentives (EMI) The most popular and tax advantageous share scheme for UK businesses. Learn more. |

|||

| Growth shares The flexible way to reward virtually anyone for their help in growing your business. Learn more. |

|||

| Unapproved options The flexible way to grant options to virtually anyone. Set time or performance-based conditions recipients must meet for their options to vest. Learn more. |

|||

| Agile Partnerships Co-founder equity splits and prenups to protect the interests of founders and their business. |

|||

| Ordinary shares You can easily issue shares to new and existing shareholders, with all the paperwork taken care of. |

|||

| CSOP Company Share Option Plans are a tax efficient way to motivate, retain and reward employees. |

|||

| Phantom shares Phantom shares are a form of conditional equity, but instead of shares being issued upfront, the recipient receives a cash bonus equal to the value of the shares. |

|||

| Options over shareholder shares Granting options over a shareholders’ shares avoids dilution. The process is usually complex, but incredibly simple with Vestd. |

|||

| Customer support level | |||

| Self serve | |||

| Scheduled video & phone support | |||

| Scheme design & management support | |||

| Add ons | |||

| Additional valuations A company valuation is needed when granting shares/options and is typically valid for up to 90 days. If you use up your valuations for the year, you can get another for a one-off fee. |

|||

| 409A valuations A type of valuation that’s essential when granting options to US taxpayers. This fee can be split into monthly payments. |

|||

| Existing scheme digitisation Upload existing share schemes to Vestd for a one-off fee and eliminate paperwork and HMRC filing headaches. All shareholders and option holders invited to Vestd will get their own dashboard too. Learn more. |

|||

| Live HMRC submission support We know how confusing and nervous it can be submitting things to HMRC. So our experts can guide you through the entire process over video call. |

|||

| New share classes You can create additional share classes for investment rounds or share schemes. Vestd takes out all the guesswork and files the required documents with Companies House. |

|||

| Companies House reconciliations We’ll provide solutions for incorrect filings and other Companies House discrepancies so your Vestd account and cap table is all correct. |

|||

| Bespoke option agreement digitisation If you want to use your own option agreement template rather than Vestd’s option agreement, we can upload it to the platform ready for you to use. |

|||

| Vestd Nominee Structure for up to 50 shareholders | |||

| Share movement history Relevant if any activity has taken place since incorporation and before joining the platform. Our team will send you a data capture file for completion. Once received we will import your full cap table history into the platform. This will enable the share register and scenario modelling features to function fully. |

|||

Plans for growing companies

Build a winning team and unlock your potential

Share schemes

Design and launch a share scheme for your team, from £300 / month.

Equity management

Digitally transform the way you monitor and manage ownership, to maintain compliance.

Company secretarial

Avoid filing docs and paperwork manually. The platform will do this automatically.

Company valuations

Request up to date share scheme valuations for HMRC, or 409A valuations.

Request a demo

Ask us anything about the platform via a free consultation from one of our experts.

Select an option below:

- Companies

- Investors

- Accountants

Share schemes

Pricing is based on the level of support and number of scheme members. Minimum term is 12 months.

Choose annual billing to get two months free.

Full Service

The works: hands-free equity management

Enquire for pricing

Enquire for pricing

Share scheme design, implementation & management

Complete support and a dedicated account manager

Briefing for your team

Live HMRC submission support (via screen sharing, videos or phone)

Most Popular

Guided

All share schemes & guided support

From £4,200 / year

From £420 / month

Scheme set up support

Unlimited valuations

New share classes

CSOP & phantom shares

Live HMRC submission support (via screen sharing, videos or phone)

Self-Serve

Self-service equity for small businesses

From £1,600 / year

From £160 / month

Only available to existing customers

Share schemes for up to five recipients

EMI Schemes, Growth Shares & Unapproved Options

Full Companies House integration is included in all plans.

Ready to explore further?

Share scheme management

Build and motivate your team

Tax-efficient rewards

Easily set up and manage employee share schemes and digitise existing schemes. Vestd helps you design, issue, and track equity, making it simple to reward and motivate your team.

Company secretarial

File docs and forms at the touch of a button

Wave goodbye to paperwork

Stay compliant and manage admin and legal tasks effortlessly. Vestd simplifies your statutory filing, shareholder communications, and record-keeping. Including automated filings and notifications.

Equity management

Fully synced to Companies House for accuracy and speed

A single source of truth

Keep your cap table updated, issue shares, and hold your legal register all in one place. 100% digital: no forms to complete.

Shareholder dashboards

Get real-time updates and model future value scenarios

Keep eyes on the prize

Shareholders can log in to track the value of their stake, calculate the potential value based on projected valuations, and receive real-time updates on any changes to their holdings.

The platform itself allows you to manage all aspects of share and option management concisely in one place. The automations and integrations save you time. But while the platform is great, it is the team that makes Vestd stand out. From pre-sales to onboarding and the ever-helpful support team - not only do they support on the platform but provide excellent knowledge in this area.

Great platform. The team always provide brilliant support. I would definitely recommend using Vestd to anyone who needs to set up and administer an EMI scheme.

Straight forward and structured approach - so good for founders and also FD/CFO/advisor who is looking to get share capital and share option schemes in place.

A fantastic platform. The price is fixed. The customer support is fantastic and readily available. They have held our hand right through the whole process.

I love Vestd and I wish I had found it sooner. It makes the whole process of issuing shares whether they're growth shares or ordinary shares incredibly simple.

Amazing shift from Excel to Vestd. The support team were amazing and did a great job of completing our setup and we have been very pleased at being able to better manage our governance over time.

Frequently asked questions

-

What happens if I cancel my subscription?

If you cancel your subscription, you'll lose access to all share scheme management features.

This includes the ability to issue shares, reward employees, and manage what happens to a recipient’s options/shares when they leave the company.

Your recipients will not be notified of their options vesting, you won’t be able to manage existing live shares, and you will have to manually track your option pool.

Additionally, you'll stop receiving the documents required for your HMRC notifications and lose access to document signing and storage features. -

Will I need to pay for your service yearly?

Yes, our service comes with a minimum 12-month term, which automatically renews.

We’ll send you a reminder before renewal, and our team is always available to ensure your plan continues to suit your needs.

Our platform is designed to streamline the ongoing management of your scheme, giving you peace of mind each year.

-

I only have two people in my scheme. Do I still pay the same rate?

Our pricing is based on tiers, starting with plans for up to 10 recipients. You'll only pay for the number of recipients you need.

-

Can I pay monthly and leave the platform after setup?

No, our service requires a minimum 12-month commitment. The platform is built to offer ongoing support for managing your share scheme, including help with administration, document signing and storage, as well as automatic HMRC reminders, and more.

-

Do your prices include VAT?

VAT is charged in addition.

-

What should I expect when I join?

Once you sign up, depending on your pricing plan, your Customer Success contact will arrange a welcome call to guide you through the next steps.

We’ll move at your pace, but your active involvement will be essential to ensure everything progresses smoothly.

-

Can I change my plan?

Yes, we understand your needs may evolve. After your initial 12-month term, we’ll gladly review your support and functionality requirements with you.

You can also upgrade your plan at any time, which will start a new 12-month term.

-

Is there a limit to the number of shareholders I can have?

No, our platform allows you to manage an unlimited number of shareholders, unlike some other providers that may have restrictions.

-

How many recipients can I include in my share scheme?

Our pricing is tiered based on the number of recipients. To find the plan that best fits your needs, please speak with one of our Equity Consultants for personalised advice.

-

How long is the subscription term?

The minimum subscription term for all plans is 12 months.

Subscriptions automatically renew each year, and we'll send you a reminder before the renewal date.

If you need to cancel, you may do so after the initial 12-month period. However, we're always here to discuss any changes and make sure you're on the plan that best meets your needs.