Share schemes & equity management for startups, scaleups and established UK companies.

Get started

Get started

Manage your portfolio with ease and evaluate potential investments.

Manage

Manage

Add your investments for complete visibility of your shareholdings. View cap tables and detailed share movements.

Model

Model

Explore future value scenarios based on various growth trajectories, to figure out potential payouts.

SPVs

SPVs

Set up and manage new SPVs without leaving the platform, then invite co-investors to fund and participate.

Platform

Use cases

Read more reviews >

Support

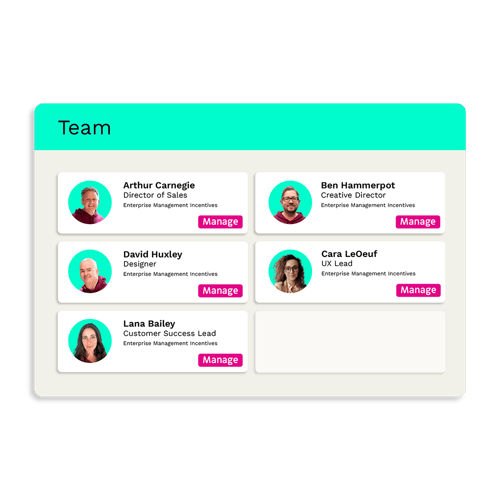

The Joy of Enterprise Management Incentives

Read our free guide to the UK's most tax-efficient share scheme.Get the guide

Company valuations for share schemes

Vestd customers get up to four valuations a year for EMI, growth shares, CSOPs and more.

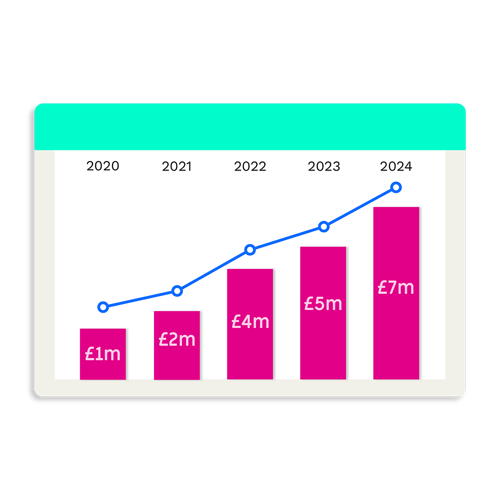

Trusted by thousands of founders

Save thousands compared to traditional providers with share scheme plans that include valuations.

Share scheme valuations are a specialist area. Our in-house analysts check every valuation.

You’ll need new valuations as the company grows, maybe multiple each year. We’ve got you covered.

Ensure tax certainty for option holders, and get a valuation that stands up to HMRC’s standards.

4.8 /5

4.9 /5

Features

Digital cap tables

Shareholder records & comms

File confirmation statements

Full Companies House integration

Enterprise Management Incentives

Share scheme digitisation

Company secretarial tools

Share scheme design & set up

The platform itself allows you to manage all aspects of share and option management concisely in one place. The automations and integrations save you time. But while the platform is great, it is the team that makes Vestd stand out. From pre-sales to onboarding and the ever-helpful support team - not only do they support on the platform but provide excellent knowledge in this area.

Great platform. The team always provide brilliant support. I would definitely recommend using Vestd to anyone who needs to set up and administer an EMI scheme.

Straight forward and structured approach - so good for founders and also FD/CFO/advisor who is looking to get share capital and share option schemes in place.

A fantastic platform. The price is fixed. The customer support is fantastic and readily available. They have held our hand right through the whole process.

I love Vestd and I wish I had found it sooner. It makes the whole process of issuing shares whether they're growth shares or ordinary shares incredibly simple.

Amazing shift from Excel to Vestd. The support team were amazing and did a great job of completing our setup and we have been very pleased at being able to better manage our governance over time.

Frequently asked questions

-

Why do I need a valuation?

If you're thinking of setting up a share scheme, it's highly likely you'll need a valuation for:

- Tax purposes

You need to know the value of your company’s shares to calculate how much tax is due on your side. And to give recipients tax certainty too, should they wish to exercise their right to buy their EMI options for instance, which is just one example. Plus, depending on the scheme you set up and whether it qualifies for tax relief, there could be a limit on the value of the shares you can give in the first place. - HMRC

For government-backed schemes such as EMI, SIP, CSOP and SAYE, if HMRC’s Shares and Assets Valuation team agree with the value of the company’s shares (as outlined in the valuation) then you can be assured of tax certainty. Without that confirmation, there’s a risk of both the company and the intended beneficiaries of the scheme losing out on the tax benefits.

- Tax purposes

-

What kind of valuation do I need?

It depends on the scheme you’re setting up. Because of the tax and legal implications, share scheme valuations are a specialist area. (Good thing you’re talking to share scheme specialists!)

If you're setting up an EMI or CSOP scheme, we can provide tax valuations ready to go to HMRC. For EMIs, we'll also help with the VAL231 form.

You'll also need tax valuations for growth shares and unapproved options.

To reward stock options to US taxpayers, you'll need a 409A valuation, which we can provide for a small additional fee.

If you’re seeking investment, you need a commercial valuation, which we don’t offer currently (but never say never).

-

Why choose Vestd?

For starters, we have a dedicated in-house valuations team, so you have a single point of contact. We keep up to date with the latest HMRC guidance and have an enviable track record of successful submissions. We take the time to understand your business and personalise reports.

-

How many valuations are included in the cost?

Our standard plan includes one valuation per year. And our guided plan covers up to four per year, which usually is more than enough. (Excludes 409A valuations). Click here for more information on pricing.

Valuations are only available to existing customers.

Vestd for

© 2025 Vestd Ltd. Company number 09302265. Registered in England and Wales.

Vestd Ltd is authorised and regulated by the Financial Conduct Authority (685992).

Registered office: Suite LU.231, The Light Bulb, 1 Filament Walk, Wandsworth, SW18 4GQ.