Vesting: what it means for your share option scheme

Last updated: 27 June 2024. There are many ways to increase employee engagement and look to reward your employees for their hard work. For sure, you...

Manage your equity and shareholders

Share schemes & options

Equity management

Migrate to Vestd

Company valuations

Fundraising

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

Last updated: 16 April 2024

There's a lot of jargon in finance, investment and even in business more broadly. Two words that don’t seem to go together, but actually do, are ‘vesting’ and ‘cliff’.

To fully understand how a share option scheme works as a long-term incentive, you need to know what these two words mean.

Vesting is the process of gaining full ownership of an asset - in the case of an option scheme, share options.

A vesting schedule outlines the time it takes for someone's options to mature, i.e. vest. In other words, instead of being able to access their options immediately, that person effectively earns their options.

Vesting schedules vary from company to company, and while commonly time-based, they can also be tied to performance-based goals.

75% of Vestd customers include time-based vesting in their scheme design.

For instance, a company might decide that an employee needs to work for the business for five years before their options can fully vest. Or, they may need to hit a certain sales target.

We call it conditional equity. For best-in-class examples of the kinds of conditions you can set, check out our Conditional Equity Milestones guide.

Once the entire vesting schedule is complete, the employee will have earned all of their options.

That's vesting in a nutshell. We'll talk about how crucial a vesting schedule is to your company share scheme later, but for now, let's move onto the cliff.

Nothing to do with land and everything to do with equity, a cliff is a welcome addition to a vesting schedule.

A cliff is a period of time that must pass before any options can start to vest, after which they do so on a set schedule.

Typically, a cliff is one year - that means that 12 months must pass before an employee's options can start to vest. Think of it like a probation period.

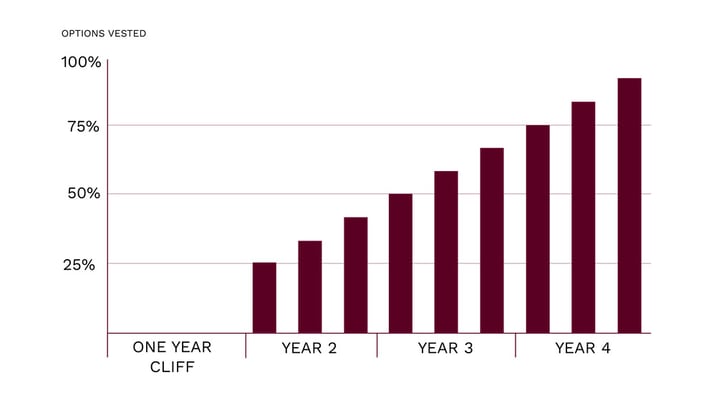

A common vesting schedule is four years with a one-year cliff.

58% of Vestd customers that add a cliff, add a one-year cliff.

But what does that mean? Let's take a look:

In short, a vesting schedule with a cliff acts as a long-term incentive, encouraging employees to stick around and later claim their equity reward.

We've helped thousands of founders set up share schemes, and time-based vesting is the most common structure we see. But vesting doesn’t have to be time-based, it can be based on performance goals or a mixture of the two.

Having a mixture of the two is called ‘hybrid vesting’. It means that an employee must remain with the business for a set number of years and also achieve a performance-based milestone before all or some of their options vest.

Vestd's intuitive scheme designer allows you to create a vesting schedule specifically tailored to your business and your team.

Some new starters might be disappointed that they can't get their hands on their options right away. Or see it as a risk. Before the initial qualifying period is complete, the contract could be terminated for some reason, e.g. a hostile business takeover.

Others will be buoyed by the incentive, and commit to staying with the company to help it grow to maximise their gains down the road - if the company grows in value, so does the value of their options.

A one-year cliff allows you to allocate employees options as soon as they join (rather than promise them they’ll get options later) motivating them right at the very start. But if they leave within a year, they leave with nothing, protecting the business' best interests.

It's also possible to seriously over-complicate a vesting schedule. If you attach too many conditions, you run the risk of demotivating folk, which is why it's best to keep it simple and give employees the chance to watch their options vest in realtime.

Keen to get your scheme set up? Look no further. Our equity consultants can help you choose the right share option scheme for your business, and show you how the platform makes designing a scheme with a vesting schedule simple.

Take a sneak peek or go right ahead and book a free, no-obligation consultation.

In the meantime, why not download our free guide to share scheme design? It covers the basics of vesting, best practices and answers common questions we hear all the time.

Last updated: 27 June 2024. There are many ways to increase employee engagement and look to reward your employees for their hard work. For sure, you...

Last updated: 17 April 2024 When you award options to an employee as part of an Enterprise Management Incentive (EMI) scheme, they don’t become...

Last updated: 16 April 2024 If you’re planning to start an EMI share options scheme for your business, one of the first decisions you’ll need to make...