8 reasons why it is important to plan your business exit strategy now

Last updated: 8 June 2024. Guest post written by John Courtney, Founder and Chief Executive of BoardroomAdvisors.

Manage your equity and shareholders

Share schemes & options

Equity management

Migrate to Vestd

Company valuations

Fundraising

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

This blog is more than four years old. Some information may no longer be current.

One of the main reasons for sharing ownership with your team is to increase employee engagement and commitment.

Studies have shown that people who have equity in a business are more loyal, more productive and care more about the company’s long term success.

The business case for giving people shares or options is very strong, but how can you best communicate the value of owning a slice of the action to your team?

Real shares give people immediate ownership in a business, but options typically vest over a number of years, so it can be more difficult for options holders to get to grips with their position.

With this in mind we have created a new option holder dashboard, to give people the strongest possible connection with their options, and consequently the company.

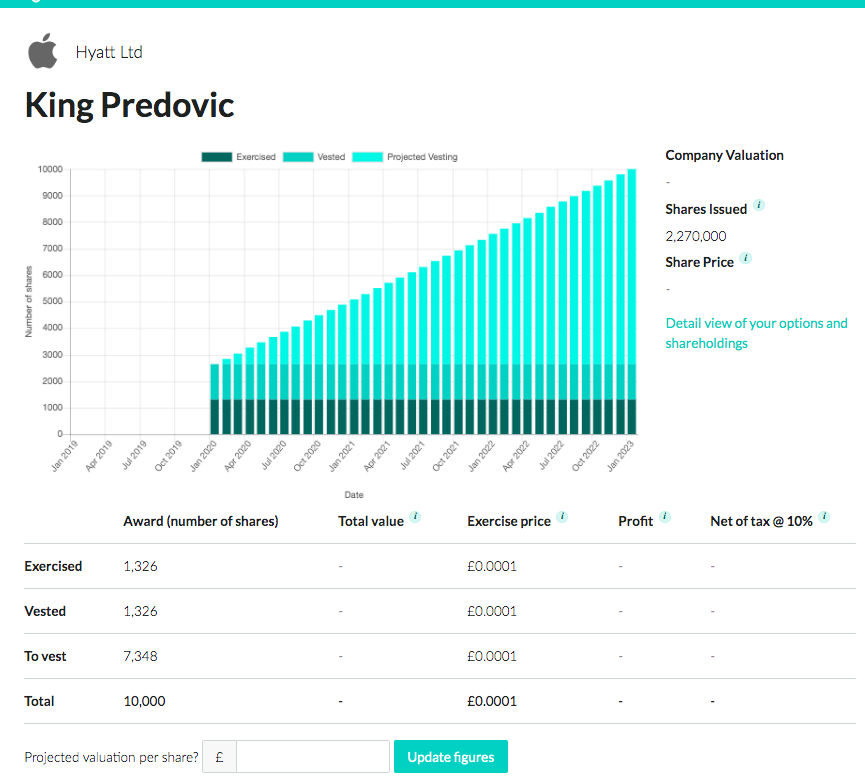

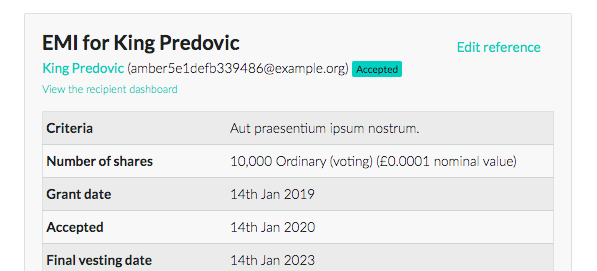

Option holders can quickly see their full vesting schedule, in an easy to digest format. Here’s what it looks like in its simplest form…

This is what option holders will see when they sign in. It provides them with a clear, visual representation of their current position, what’s been exercised, what’s vested, and what’s coming down the line.

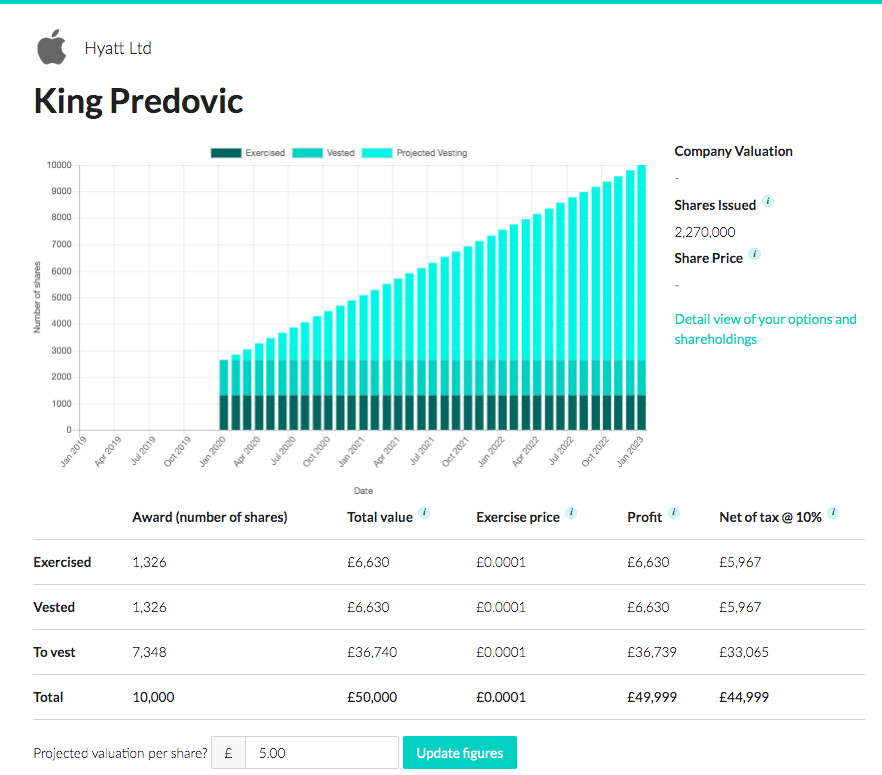

It also allows them to model what the future value might look like…

Option holders can add a projected share price, to see what their piece of the pie could grow to. This will help keep minds focused on growing the business… and their potential prize.

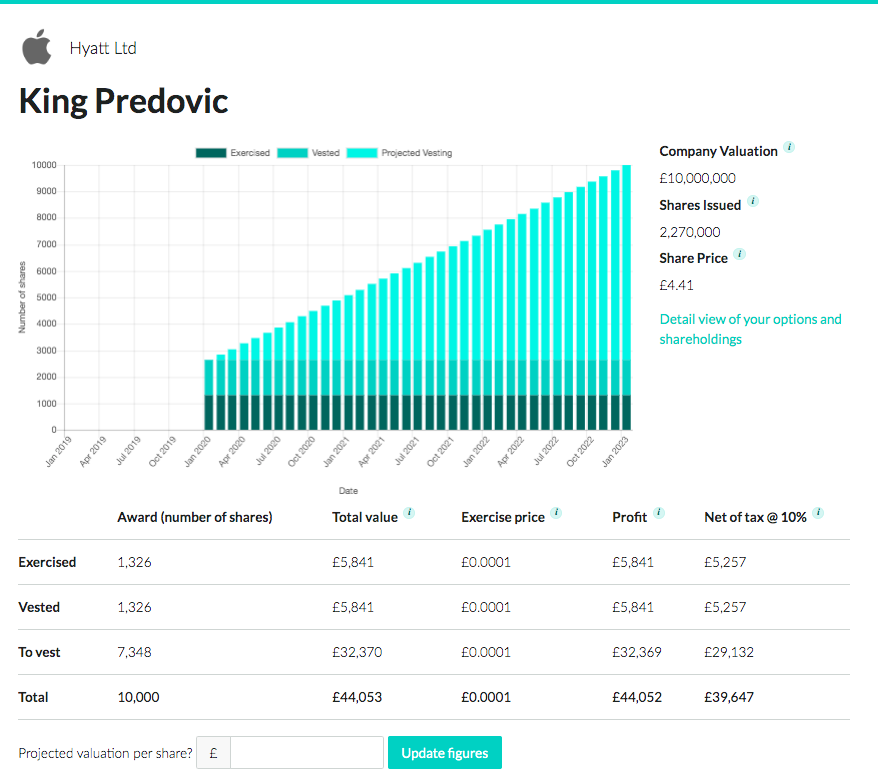

The app will show the dashboard as above, but this can be enhanced in two ways, both of which you control.

If you enter a new company valuation via the valuations icon on your company dashboard then this will immediately flow through into each recipient’s portal, including any commentary you may make about the valuation, and its source (such as ‘Series A investment round’).

The app shows a non-diluted view by default, taking into account only the publicly issued shares and the recipient’s own options.

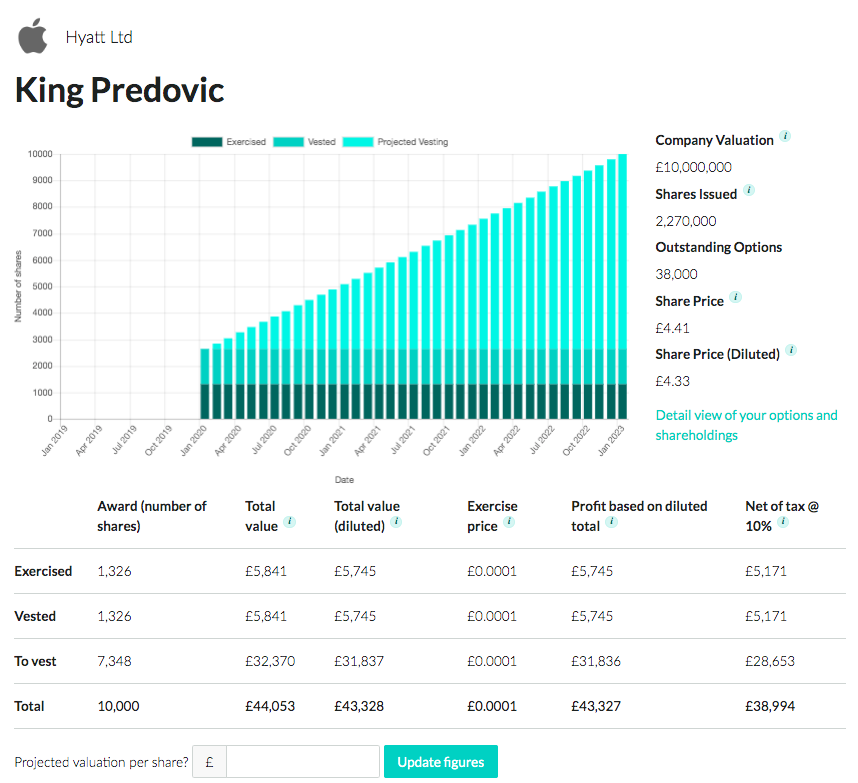

Companies can choose to show a fully diluted view, including all options that have been accepted and are still live, if there is no sensitivity about revealing how many options have been issued.

Option holders will then see the number of outstanding options and the diluted share price to the right of the chart, as well as the effective price of the shares they hold / have options on.

Option holders can continue to access their option agreements and scheme management features, as well as seeing how many shares that they may have, through the link at the bottom right of the graph.

Early feedback among beta testers has been fantastic, and we believe that this is going to help your team feel more engaged, and more interested in the growth of the business.

There are three things you might like to do…

If you want to see what your recipients can see, just go into their option and click on ‘View the recipient dashboard’ link…

This is another step in making Vestd even better, for company admins and scheme recipients. It is very much a first version, so please let us know what you like, don’t like, or how it could be enhanced.

Last updated: 8 June 2024. Guest post written by John Courtney, Founder and Chief Executive of BoardroomAdvisors.

FounderMetrics host Ifty Nasir dives into crucial metrics to empower founders like you with the insights to make powerful decisions.

It’s a classic business tactic to look for a need that isn’t being met and to provide a solution.