Slicing Pie: A tasty way to share equity?

Last updated: 16 April 2024

Manage your equity and shareholders

Share schemes & options

Equity management

Migrate to Vestd

Company valuations

Fundraising

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

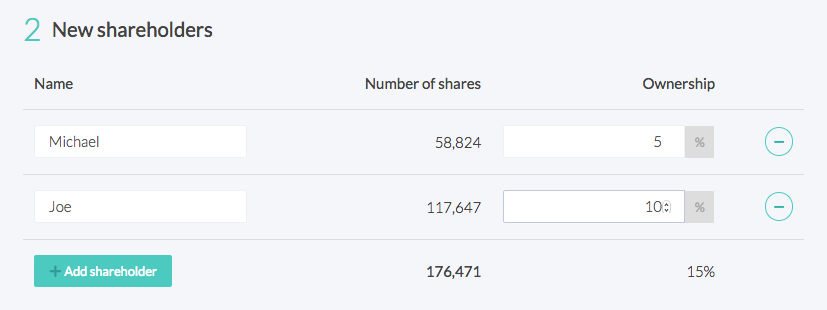

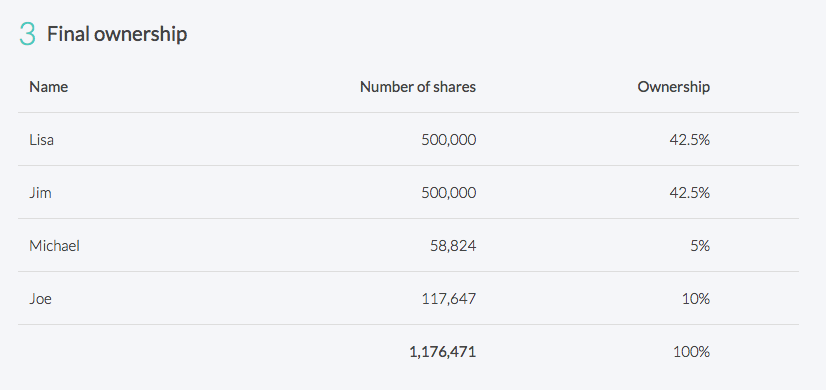

Some of us struggle with the maths when trying to work out exactly how many shares (or options) to give to a member of the team so that they end up with 5% of the company.

To make it easier, we have generated a really basic shared ownership calculator that does the hard work for you.

Just stick in the existing shareholders (either individually or as a single block) and the number of shares they have.

Then put in the other members of the team and the percentage of the company you want them to end up with.

The calculator does the rest. It’s as simple as that.

If you think this is useful, please share it.

Try out the shared ownership calculator now.

Last updated: 16 April 2024

Last updated: 23 November 2023. There are many different ways to share ownership. EMI options are the most tax-efficient for your employees. Growth...

Last updated: 2 October 2024. We’ve devised a new calculator to help you calculate how many shares to issue to employees, key players, basically,...