Six lessons from the Employee Share Schemes for SMEs conference

When you enter a room that’s full of people who all share your belief in the power of ownership, you know you’re going to have a good day. At the...

Share schemes & equity management for startups, scaleups and established UK companies.

With two-way Companies House integration, the platform is fast, accurate and powerful.

Manage your portfolio with ease and evaluate potential investments.

The platform is fully synced with Companies House, to provide you with accurate, real-time insight.

Add your investments for complete visibility of your shareholdings. View cap tables and detailed share movements.

Organise investments by fund, geography or sector, and view your portfolio as a whole or by individual company.

Explore future value scenarios based on various growth trajectories, to figure out potential payouts.

Remove friction and save time. Action shareholder resolutions via DocuSign, access data rooms, and get updates from founders.

Set up and manage new SPVs without leaving the platform, then invite co-investors to fund and participate.

Updated 7 February 2024.

If you are considering creating an Enterprise Management Incentive scheme (EMI), you may be concerned that this process of rewarding your team represents a lot of time, complicated paperwork, and difficult back-and-forth communication with HMRC.

And with an estimated 50% of new EMI schemes being found non-compliant at the time of exit, you may be worrying about further costs and headaches that only emerge after the scheme is established.

At Vestd, we’ve built a tool that helps hundreds of UK businesses efficiently manage their share option schemes including EMI.

So we know from experience that if your business has the proper resources, support, and guidance, you can set up a scheme that’s compliant from the very start, and reward your team with the shares they deserve for a job well done.

This 10-minute guide will teach you the six steps to setting up an EMI options scheme.

While there’s plenty to take in and no shortcuts to success, we’ll show how you can get help with the process - and avoid any potential pitfalls that may arise along the way.

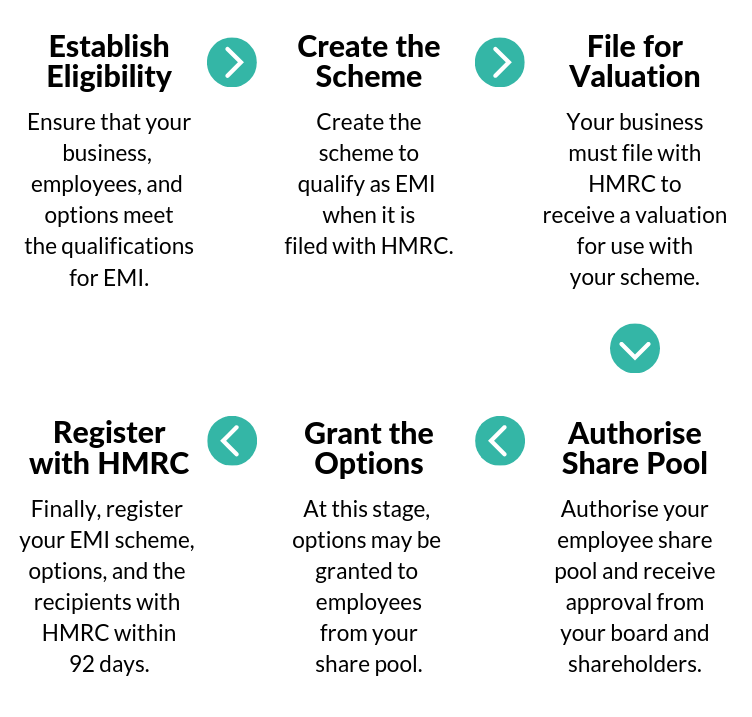

Here is the process we share with businesses:

This diagram shows the steps you’ll take to ensure your organisation’s EMI scheme is created properly and is eligible to qualify as an EMI with HMRC upon registration:

Let’s go through these steps in more detail so you understand what you need to do at each stage, and who to contact for help if you get stuck or have questions about compliance.

Before you do anything else, you’ll need to ensure you and your team are actually eligible for an EMI scheme.

Doing this first guarantees that there aren’t any surprises when you file with HMRC. You don’t want to find that you don’t qualify at the final step after doing so much work to prepare!

First, you’ll need to meet eligibility requirements for the scheme itself. HMRC lists the main requirements as follows:

Secondly, there are requirements that your business must meet to qualify for EMI:

Third, there are eligibility requirements for employees to participate in the EMI scheme:

If you aren’t certain about whether or not you meet these criteria or will meet them in the future pending possible changes to your business, a partner like Vestd can help you answer these questions and suggest changes to avoid non-compliance with the scheme.

If your proposed scheme, organisation, and employees meet these criteria, you are ready to proceed to the next step.

If you meet the eligibility requirements, your next step is to actually create the EMI scheme. This usually involves making decisions on the finer details, including if it will be exercisable or exit-based and what the vesting schedules will look like for each individual receiving EMI options.

Creating the scheme at this stage will prepare you for the next steps in the process, including filing for valuation and receiving approval from your board and shareholders. It will also help you better prepare to answer questions from your team.

You will eventually register with HMRC, but not yet: there are a few other crucial steps to take first.

At this stage, you will need to file with HMRC to receive a valuation of your business. This process typically takes between two and four weeks from start to finish. Filing for and receiving a company valuation from HMRC has two major benefits:

To proceed, you should first have a valuation report carried out for your company. You can either do this yourself with the help of an accountant or if you are working with us here at Vestd, we will do it for you.

Once you have the report, submit it to HMRC via email or post along with a completed VAL231 form.

This valuation is valid for 90 days from the time HMRC approves it, which will happen via letter. Once you have received it, you are ready to move on to the next step.

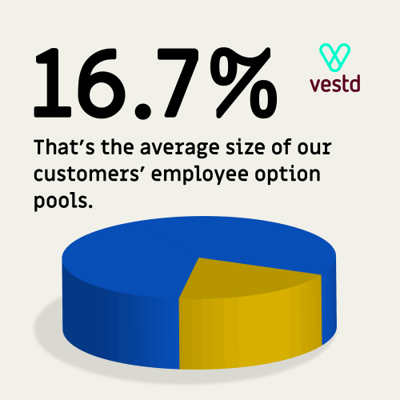

With your valuation in hand, you should now create the share pool from which you will issue EMI options to your team.

Deciding on the size of this pool and the number of options to issue to your employees can be difficult. The average among our customers is 16.7%.

We have written a guide with plenty of advice on this subject, and you can also reach out to the Vestd team to get our insight on what is best to do in your particular case.

If you have an advisory board, external investors, or any other existing shareholders, you must also seek their approval at this stage before making any option grants to employees.

Most companies require formal approval both from their board and shareholders to set up and execute an options scheme. Your board and existing shareholders will likely want to review and approve the following items:

Once the board is satisfied and approves your decisions, you can proceed to grant EMI options to your team members. You’re almost finished!

At this stage, you may now grant EMI options to your team members. Upon doing so, you should also be certain to explain the scheme and its meaning to them.

Your employees will likely want to know why you have chosen an EMI share scheme, and how it will benefit them. They may also have some questions about the tax implications of their options, or how to exercise them in the future.

We have written a guide to engaging with your team about a share scheme that you may find useful at this step, as well as in the future.

You’ve reached the final step — congratulations! After granting options to your team, you are now finally ready to register your EMI scheme and its granted options with HMRC. This step must be done within 92 days of any option grants.

However, we typically recommend that our customers start this initial notification process at least two weeks before the end of the 92 days; there are multiple steps required, and HMRC may not respond to your registration or any questions immediately.

The process of registering is as follows:

Once you’ve received confirmation that HMRC has received your option grant notifications, you are done with the process. Your EMI scheme is now fully established and ready for operation at your organisation.

Now that you know the six steps you should take to create a compliant EMI share scheme, you are almost ready to get started.

But setting up the scheme isn’t everything.

You also need a good tool to help you manage it. There’s ongoing administration to consider: notifications to HMRC, maintaining vesting schedules, adding and removing option holders, and so on.

You’ll need advice on how to stay compliant if the size or shape of your company changes and help to keep accurate records of what’s been issued and left in your employee option pool.

This is what we offer here at Vestd. With a simple monthly subscription, we’re able to help you efficiently and accurately manage an EMI scheme over its lifetime, ensuring compliance at every step of your journey.

Our team has set up and optimised hundreds of EMI schemes for UK businesses just like yours - businesses that want to easily reward their team with options, not burden them with headaches and tax forms.

Book a free demo with us now to learn how Vestd can help you create and manage a stress-free, fully compliant and cost-effective EMI scheme.

When you enter a room that’s full of people who all share your belief in the power of ownership, you know you’re going to have a good day. At the...

Updated 6 February 2024.

Last updated: 16 April 2024