What's a cliff, and what's it got to do with vesting?

Last updated: 16 April 2024 There's a lot of jargon in finance, investment and even in business more broadly. Two words that don’t seem to go...

Manage your equity and shareholders

Share schemes & options

Fundraising

Equity management

Start a business

Company valuations

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

This article is over five years old. Some information may no longer be current.

Our product team works hard to make your life easier and we’ve recently introduced a few new features that you should know about.

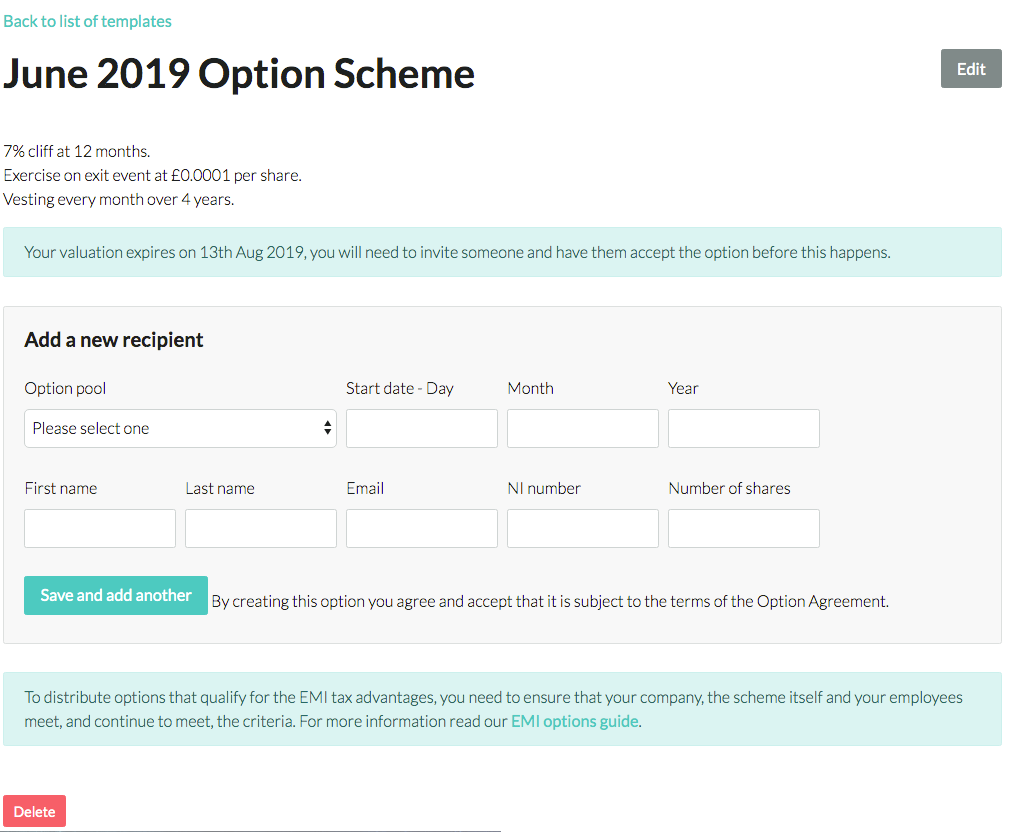

This allows you to set up the various scheme rules really easily, and then quickly allocate new options to individuals. There is no simpler way of designing an options scheme.

The scheme designer works with EMI or unapproved options. Once you have authorised your option pool and given your scheme a name you can:

For more details aim here.

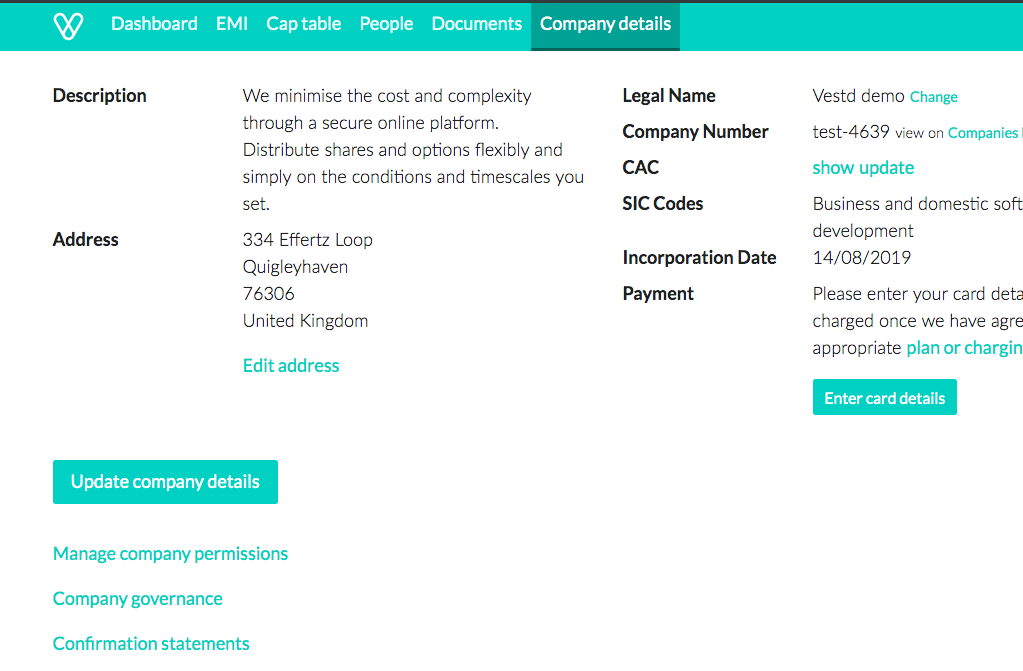

The Vestd platform automates the creation and submission of your annual confirmation statement to Companies House. It also pays them the designated fee!

Because our platform has full two-way integration with Companies House there are no forms to be filled in, no stamps to buy, and no letterboxes to locate. This makes Vestd unique.

We’ve just added a new feature to allow you to see the status of your confirmation statements all year round. You can trigger additional ones if required.

Just look for the link on the bottom left of your company details page to access these statements.

There’s no doubt that sharing equity is complicated and there are some serious pitfalls to avoid.

Our mission is to simplify employee share schemes and equity distribution, so that UK entrepreneurs and company directors can reward key people by sharing ownership.

Education is a big part of this. Our team has helped hundreds of startups and SMEs to manage their equity in a tax-efficient, compliant manner. We have a lot of insight to share, and have recently created some easy-to-read guides to help you.

There are lots of platform-specific help guides, so you can self-manage your scheme via our user-friendly interface.

Here are three for starters:

There are plenty of others in our help centre.

We also have a new guide for launching an EMI scheme, should you want to read about the benefits of these incredibly tax-friendly (and potentially zero-cost) option schemes.

If you have any ideas about what we could do to improve our platform then please drop us a line. We would love to hear from you.

Have a great bank holiday weekend!

Last updated: 16 April 2024 There's a lot of jargon in finance, investment and even in business more broadly. Two words that don’t seem to go...

Last updated: 21 June 2024. If you are considering creating an Enterprise Management Incentive scheme (EMI), you may be concerned that this process...

This article is more than 7 years old. Some information may no longer be current. Hallelujah! After nearly a six-week suspension, EMI schemes are...