Should I give equity to early employees? Yes, here’s why

Last updated: 19 April 2024

Manage your equity and shareholders

Share schemes & options

Fundraising

Equity management

Start a business

Company valuations

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

1 min read

Naveed Akram

:

14 September 2017

Naveed Akram

:

14 September 2017

When you enter a room that’s full of people who all share your belief in the power of ownership, you know you’re going to have a good day. At the Employee Share Schemes for SMEs conference this year, everyone there not only grasped the immense value and benefit inherent in shared ownership, but was actively trying to implement or improve it in their own business.

It was a day packed with detailed advice and interesting conversations and with so much going on it’s easy for some of the key points to get forgotten. So whether you could attend or not, here our 6 key takeaways from the event.

1. “Employees will have more interest in growing share value if they themselves have shares in the business. Shareholders have shares. Employees have share schemes. This aligns both groups interests” David Craddock

2. “Biggest threat to European businesses is poor succession planning” Stephen Woodhouse

3. EOTs (employee ownership trusts) can avoid the common pains attached with 3rd party sales when founders want to release capital.

Nigel Mason

Nigel Mason

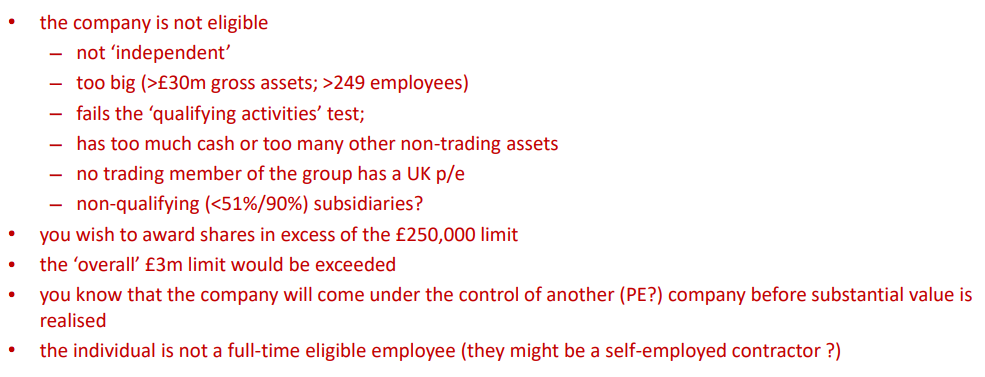

4. Reasons you could not grant and EMI option.

David Pett

David Pett

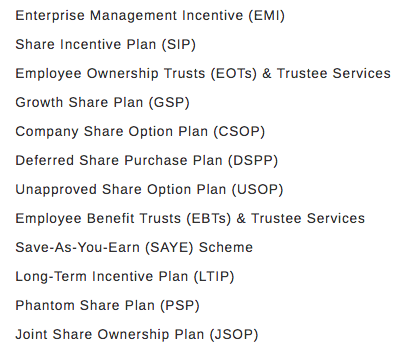

5. The variety of shares schemes available and their various restrictions can become incredibly complex (Nigel Mason)

Nigel Mason

Nigel Mason

6. Keep it as simple as possible. EMI and Growth Shares schemes consistently came up as the most tax advantageous, simple to implement and cost effective in most situations.

There were lots of interesting businesses there who I didn’t manage to talk to, but I’ll certainly be attending next year.

If you would like to chat about how Vestd could help you simplify your share scheme, please get in touch hello@vestd.com.

Last updated: 19 April 2024

Last updated: 13 August 2024. Giving shares to your employees can be an incredibly powerful motivator. It’s something that can have a much greater...

Sharing ownership with your team can be a superb way to align interests, incentivise performance and build a culture of shared success. It's a way...