A nil return is when no changes have occurred to your existing schemes in the previous tax year. If we believe this to be the case, the platform will let you know.

- To submit a nil return, you need to log into the PAYE section of HMRC's website and select Employment Related Securities.

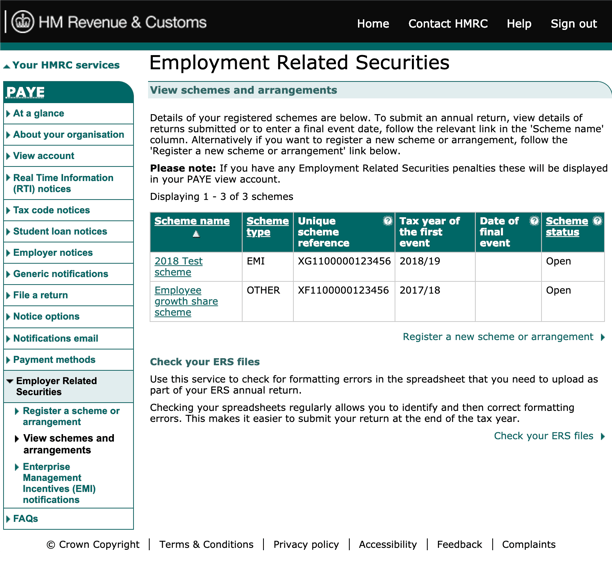

- Once in the ERS system select the relevant scheme name from the list of schemes and arrangements, as shown below.

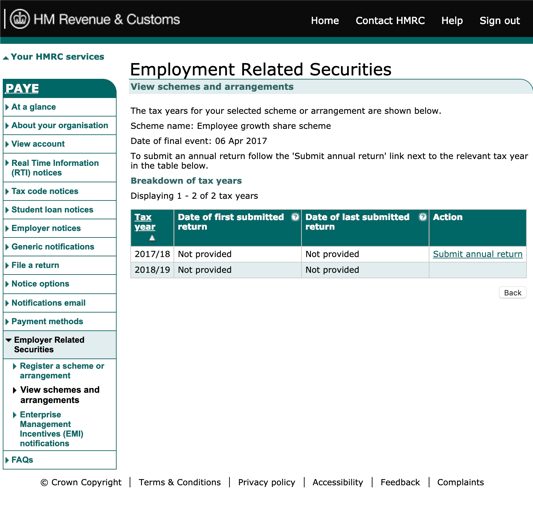

- You should then see the option to submit an annual return.

- You'll then see the screen below. Click Submit annual return.

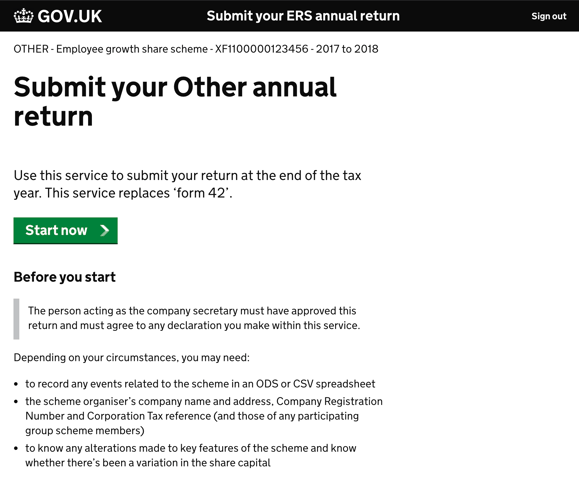

- Once in the annual submission process, click Start now to begin.

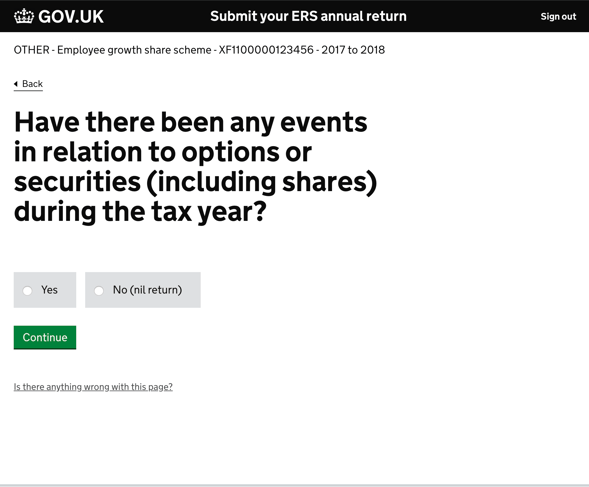

- For a nil return, there must have been no changes during the tax year (e.g. the grant, exercise or cancellation of options). To continue, click No (nil return)

- If any changes were made, you will need to select Yes here and follow the how to submit an annual notification guide.

- If any changes were made, you will need to select Yes here and follow the how to submit an annual notification guide.

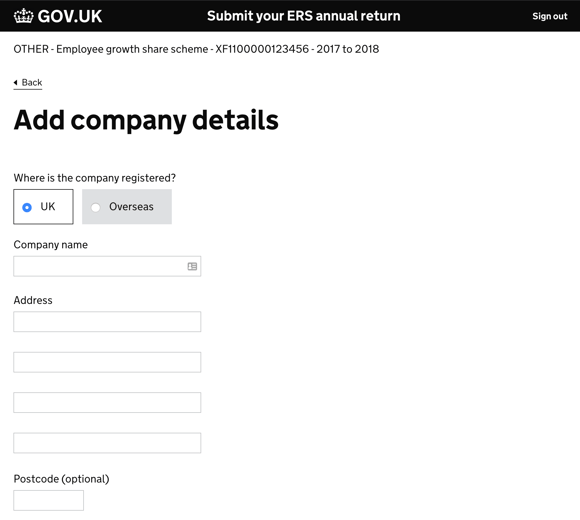

- You then need to enter your company details, the name and the registered address used with HMRC. You can also enter your company number and tax reference number onto this page, these are optional but should be entered if you have them.

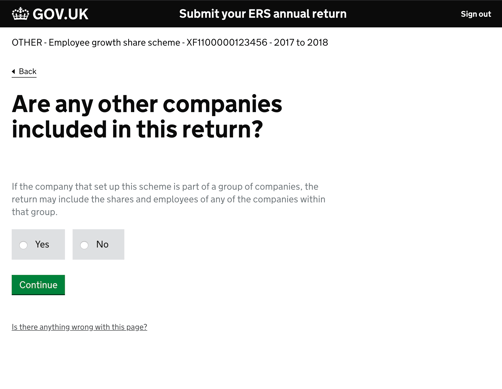

- You are then asked if you want to file for other companies - select No and continue.

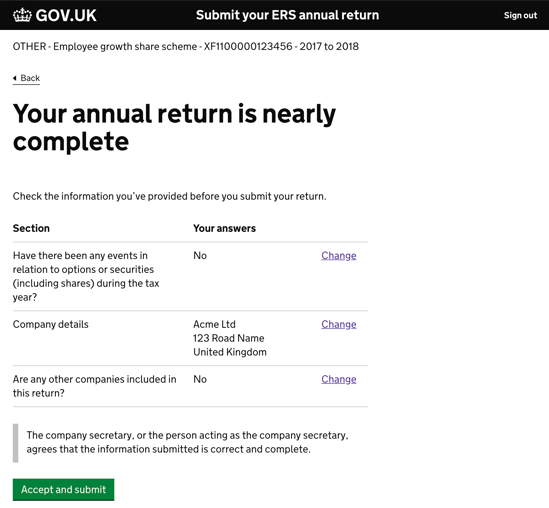

- The final page will allow you to review the details before submitting.

- The ERS system sometimes logs you out at this point. If it does, just log back in and you'll be able to continue.

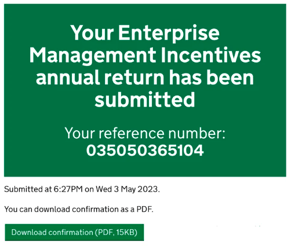

- Please download the confirmation PDF for your records, and copy the reference number. You can then save the reference number back on Vestd's Annual Notification page. Once you have updated the platform, you have completed your Annual Notification for this scheme!

If your nil return is for growth shares only and there won't be any more share issues, you can close the scheme with HMRC so you don't have to submit a nil return next year. Failure to submit a nil return can result in a fine.

Our team, content and app can help you make informed decisions. However, any guidance and support should not be considered as 'legal, tax or financial advice.'