How to submit your annual notification when no activity has taken place

Even if there are no changes to your EMI or CSOP scheme, you still need to submit a nil return.

You must submit your EMI and CSOP annual notification between 6th April and 6th July to let HMRC know that no activity has taken place in the previous tax year.

If changes have been made to existing options, you should follow this guide instead.

This FAQ provides step-by-step instructions on submitting a nil return through HMRC's Employment Related Securities (ERS) system.

Please note, if you're submitting an annual notification for unapproved options granted to UK employees or directors, the screenshots below will look different to your screen but the process should be the same.

If you have yet to register your unapproved options scheme with ERS, please follow this guide first

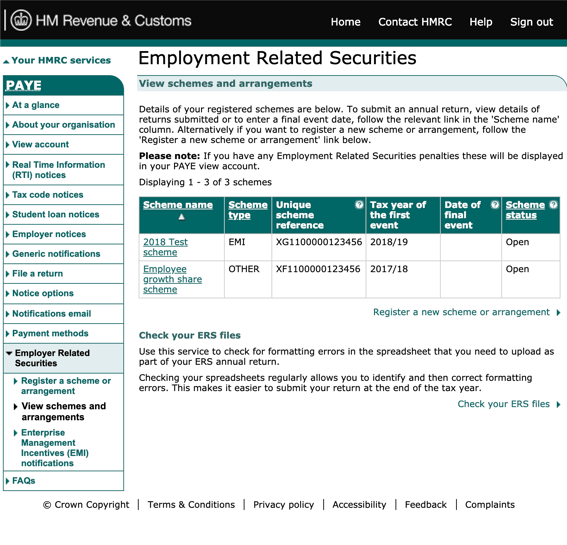

- To submit a nil return, you need to log into the PAYE section of HMRC's website and select Employment Related Securities.

- Once in the ERS system, select the scheme you're interested in filing for from the list of schemes and arrangements.

- Please note the screenshots are for submitting an EMI nil return, but the process is largely the same for CSOP.

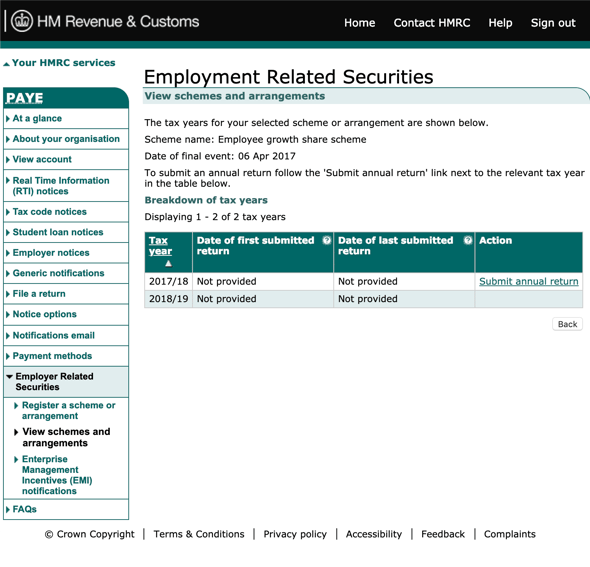

- Once you have clicked into the relevant scheme, you should see Submit annual return.

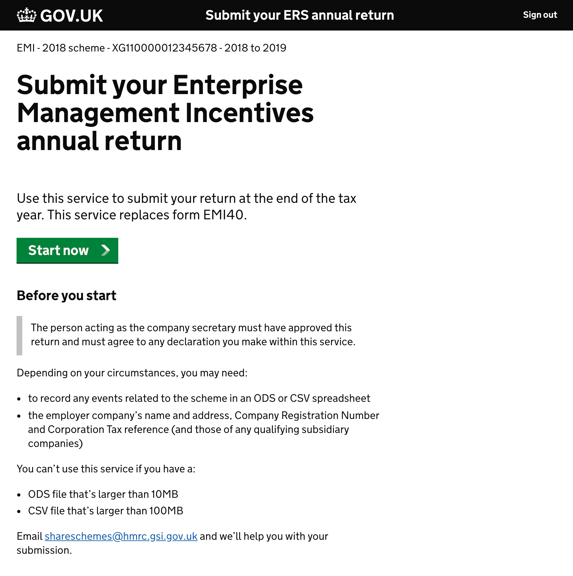

- You will now be taken to the new HMRC site. Once there click Start now to begin the process.

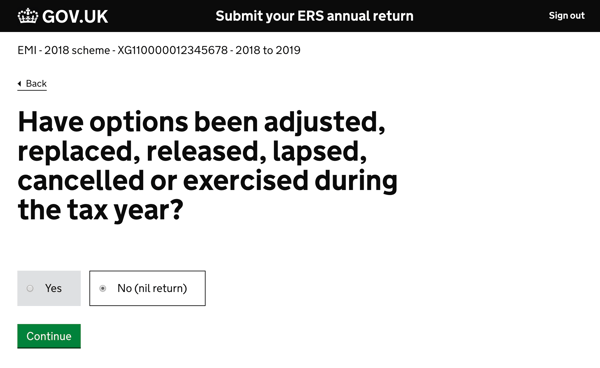

- You'll be asked to confirm if any activity has taken place. Click No (nil return)

- If activity has taken place, please follow our other help guide.

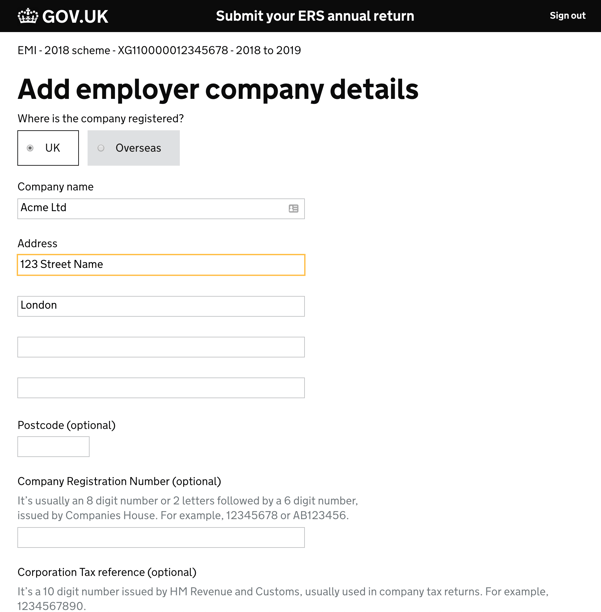

- You need to enter your company details. The mandatory fields are company name and registered address. Everything is optional, and not filing those in won't delay your notification.

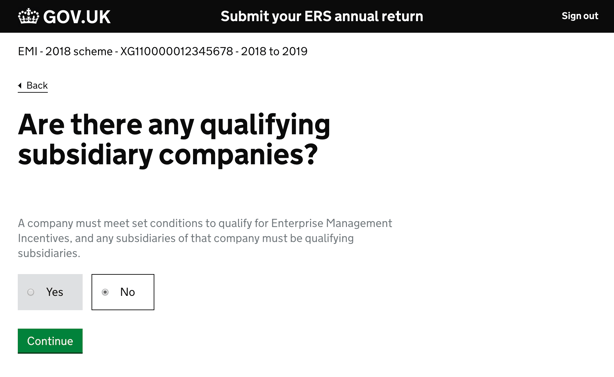

- You will then be asked about any subsidiary companies to ensure the scheme is still compliant.

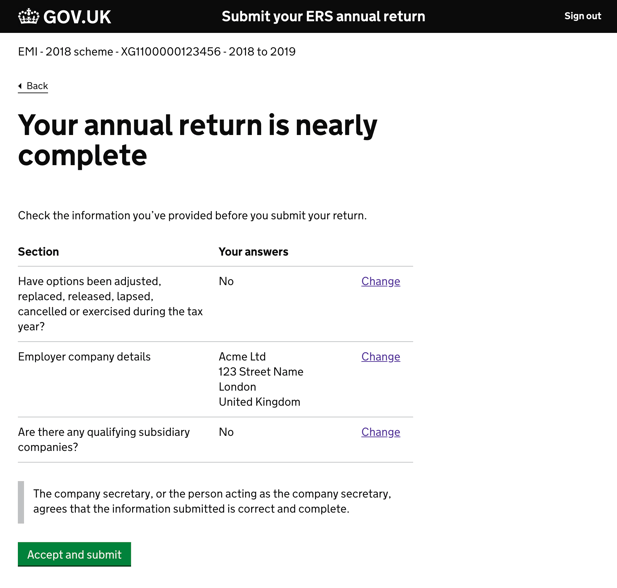

- Finally, review the information you have entered and click Accept and submit. The ERS system sometimes logs you out at this point. If it does, just log back in and you'll be taken straight to step 9.

- Please download the confirmation PDF for your records, and copy the reference number. You can then save the reference number back on Vestd's Annual Notification page. Once you have updated the platform, you have completed your Annual Notification for this scheme!

Our team, content and app can help you make informed decisions. However, any guidance and support should not be considered as 'legal or financial advice.'