Guided scheme design

Vestd provides UK companies with a fully guided service for growth shares and other share schemes. You’ll always get five star support. Get started by booking a free consultation.

Share schemes & equity management for startups, scaleups and established UK companies.

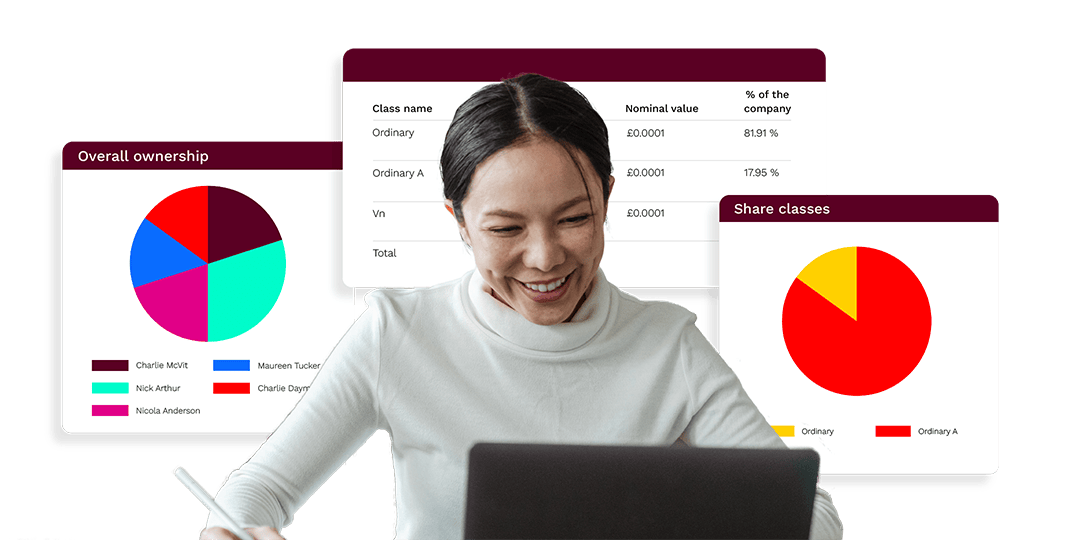

With two-way Companies House integration, the platform is fast, accurate and powerful.

Manage your portfolio with ease and evaluate potential investments.

The platform is fully synced with Companies House, to provide you with accurate, real-time insight.

Add your investments for complete visibility of your shareholdings. View cap tables and detailed share movements.

Organise investments by fund, geography or sector, and view your portfolio as a whole or by individual company.

Explore future value scenarios based on various growth trajectories, to figure out potential payouts.

Remove friction and save time. Action shareholder resolutions via DocuSign, access data rooms, and get updates from founders.

Set up and manage new SPVs without leaving the platform, then invite co-investors to fund and participate.

Book a demo

Growth shares are incredibly flexible. There are no statutory requirements or limits to abide by. Recipients benefit from growth in company value from the time at which they are issued.

✓ Ideal for non-employees

✓ Recipients become shareholders immediately

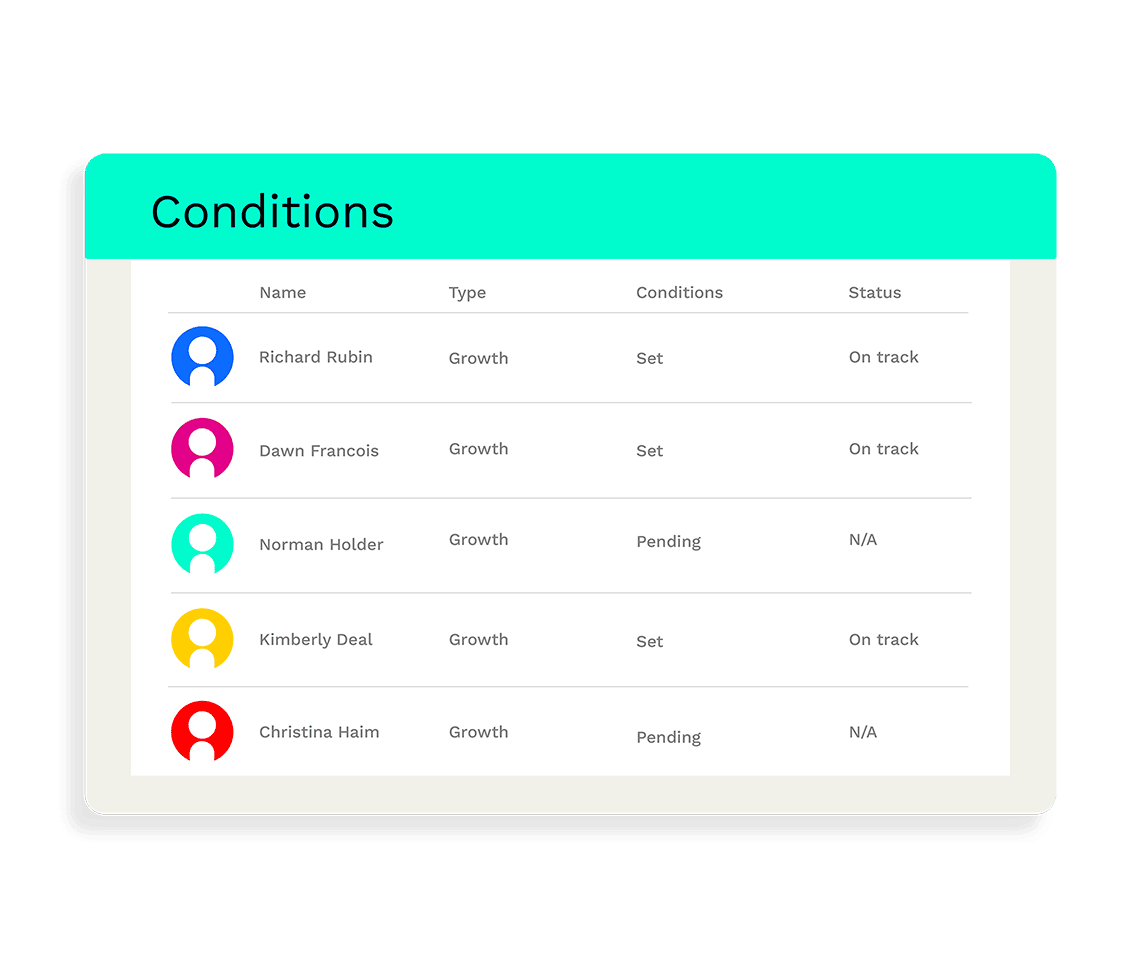

✓ All sorts of conditions can be set

Growth shares are issued at a ‘hurdle rate’ and provide recipients with a share in the future capital growth of the business. This minimises dilution for existing shareholders. Recipients don’t need to pay any Income Tax when they receive the shares, only CGT on any gains when they are sold.

You can set conditions for recipients, such as achieving milestones, or staying with the company for an agreed period of time, so long as your Articles of Association have been drafted to enable this. We’ll help you figure out the best conditions - what’s most important is that the criteria is clear and not subjective.

Vestd provides UK companies with a fully guided service for growth shares and other share schemes. You’ll always get five star support. Get started by booking a free consultation.

Growth shares are issued at a hurdle rate, which is typically a small premium above the company’s current value. We will provide you with an up-to-date, defensible valuation.

You can use the Vestd articles of association for free in the event that your articles don’t have the right provisions in place (to ensure that dilution and exits are handled correctly).

The platform itself allows you to manage all aspects of share and option management concisely in one place. The automations and integrations save you time. But while the platform is great, it is the team that makes Vestd stand out. From pre-sales to onboarding and the ever-helpful support team - not only do they support on the platform but provide excellent knowledge in this area.

Great platform. The team always provide brilliant support. I would definitely recommend using Vestd to anyone who needs to set up and administer an EMI scheme.

Straight forward and structured approach - so good for founders and also FD/CFO/advisor who is looking to get share capital and share option schemes in place.

A fantastic platform. The price is fixed. The customer support is fantastic and readily available. They have held our hand right through the whole process.

I love Vestd and I wish I had found it sooner. It makes the whole process of issuing shares whether they're growth shares or ordinary shares incredibly simple.

Amazing shift from Excel to Vestd. The support team were amazing and did a great job of completing our setup and we have been very pleased at being able to better manage our governance over time.

Thinking about giving your team some skin in the game?

We'll help you understand how to design a share scheme in next to no time. Calls are totally free and there's no obligation to use Vestd afterwards.

Growth shares are issued at a ‘hurdle rate’ and provide employees, contractors, advisors and consultants with a share in the capital growth of the business from the point at which they are issued.

For example, if they are issued at a ‘hurdle’ of £1 per share, they will only share in any eventual net sale proceeds that are over and above £1 per share. As such, existing shareholders are only value diluted for growth from that point, rather than the existing worth of the company.

Recipients of growth shares don’t have to pay income tax when they're issued the shares, but capital gains tax may be due on the sale of the shares. This scheme can be complex to create if done manually but is incredibly simple using Vestd.

For the business or recipient

For the shares

If the growth share award is still within its ‘conditional period’ then the shares can easily be fully or partially cancelled. It’s important to set this period to be sufficient to judge if the person has met expectation. Once the shares are ‘unconditional’ the recipient is the full owner of those shares (whether they stay with the business or leave) and you will not be able to cancel the award.

On sale, growth shares are taxed as a capital gain, so normally around 20%. In contrast, unapproved options normally attract a marginal tax rate of 40%, if exercised at exit, as they are then treated as income.

Yes, you can set a vesting schedule in a similar way to options. However, the ‘vesting’ is essentially the removal of the conditionality from a proportion of the total shares at specific dates.

Usually, we find that some additional elements need to be made to a company’s existing articles to ensure there are sufficient protections for the business to ensure dilution and exits are handled correctly. If you don’t have these provisions you can use the Vestd articles for free. These articles have been carefully configured by our legal partners to ensure that they future proof the company (to the extent possible) to how it might develop, be invested in, and eventually make a sale.

Each growth share award can include a unique and specific set of qualifying criteria. This could be as simple as ‘turn up each day’ or more specific and linked to key project milestone or helping the business meet specific targets. What’s most important is that the criteria is clear and not subjective.

Depending on your situation you might also want to consider EMI share options scheme or unapproved options. Speak to one of our specialists (for free) to better understand what might be best for your situation.

Yes, all growth shares are issued at a hurdle rate. This is typically a small premium above the company’s value today. Unlike EMI, this value can not be pre-approved with HMRC. However, a valuation (carried out with the support of Vestd or by your accountant) will usually provide a good degree of comfort.

Normally, depending on the nature of the company, a premium of 10-40% may be applied to the market value to reflect any “hope value” of the shares, and thus further mitigate any risk of HMRC deciding at some point in the future that these shares had been undervalued at issue.

In a worst case scenario, if they so decided, they would charge income tax on any differential between the hurdle and their determined market price at the time.

If the valuation is carried out by Vestd it is included within the Standard or Guided plan. If your accountant conducts it then you will need to ask them for a quote.