Why share dilution isn’t always something to avoid

Updated 18 September 2023.

Share schemes & equity management for startups, scaleups and established UK companies.

With two-way Companies House integration, the platform is fast, accurate and powerful.

Manage your portfolio with ease and evaluate potential investments.

The platform is fully synced with Companies House, to provide you with accurate, real-time insight.

Add your investments for complete visibility of your shareholdings. View cap tables and detailed share movements.

Organise investments by fund, geography or sector, and view your portfolio as a whole or by individual company.

Explore future value scenarios based on various growth trajectories, to figure out potential payouts.

Remove friction and save time. Action shareholder resolutions via DocuSign, access data rooms, and get updates from founders.

Set up and manage new SPVs without leaving the platform, then invite co-investors to fund and participate.

1 min read

Simon Telling

:

03 January 2018

Simon Telling

:

03 January 2018

Usually, at some point in your business’ life, you will be after investment. It can mean an exciting step forward for your business, and your team. But, as with many things in the entrepreneurial world, there are certain things you need to consider first. Particularly, how investment rounds will impact your equity.

Our investment round calculator will help you figure out that impact.

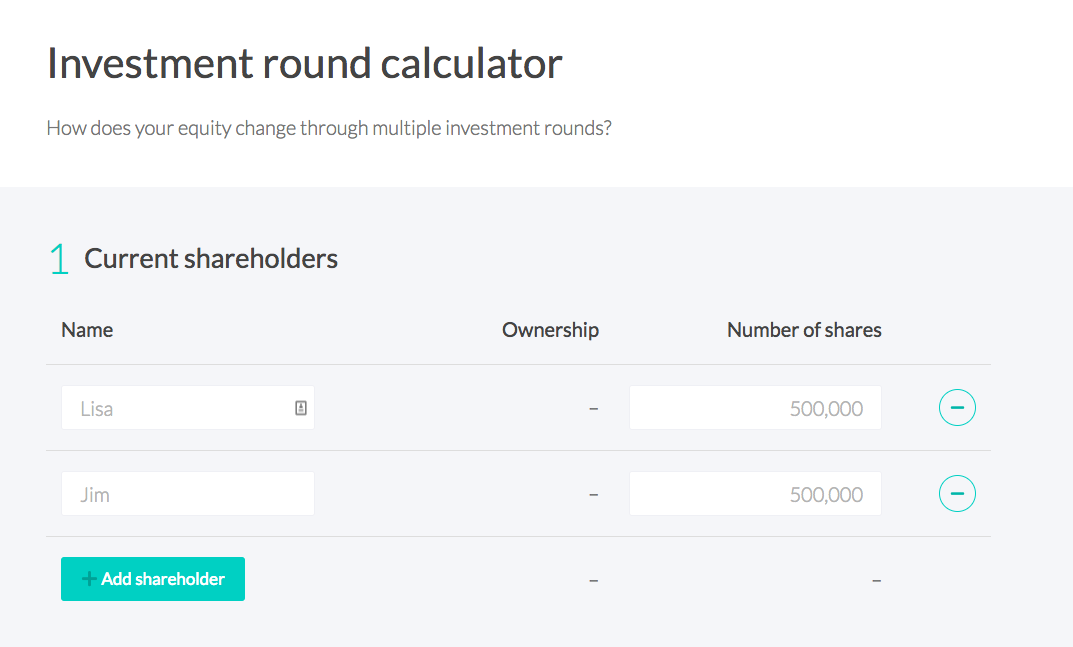

To do this you first need to know the details of your shareholders and the number of shares they currently hold. Enter that in and the calculator will tell you what that means in terms of percentage.

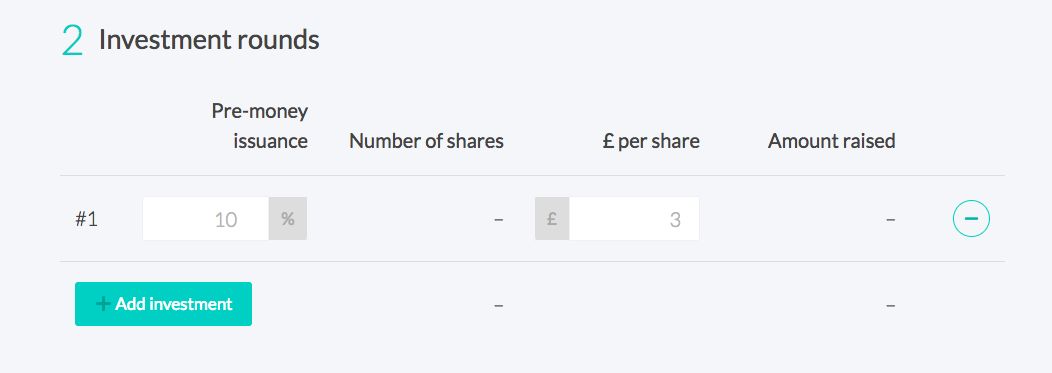

Next, you add the details of your investment round. You need to know the percentage of new equity you will issue and the cost per share. Once you’ve entered that information, the calculator will tell you what that means in number of shares you’ll need to issue, and the amount of investment you’ll get in return.

You can add as many investment rounds as you want to see the impact of multiple rounds.

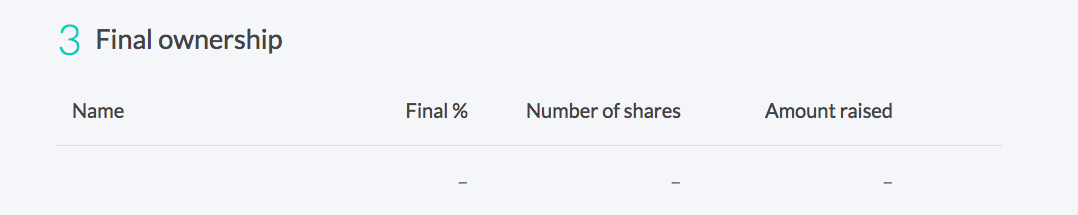

The final section of the calculator is the results. From the information you’ve entered the calculator can tell you how the investment rounds have impacted the percentage owned by your original shareholders and how many shares you need to distribute in return for the amount of investment you need.

A. Hopefully, you’ve been a savvy and sensible business owner who has already shared ownership with your team and maintained an organised and flexible cap table, (if not, see our blog for how to become one!). This means you already have a structure with multiple shareholders and probably some of those are early investors.

So, when you go for another investment round and gain more shareholders, what happens to the shares the original shareholders have? Are they diluted? If so, by how much? And the even bigger question, what’s the impact of multiple investment rounds?

B. We’ve mentioned multiple investment rounds because it’s more than likely you’ll need more than one. But how many you need and at what price is a tricky set of calculations, that few have the time and patience for.

How can you work it out simply.

By using this calculator you can easily do two things.

Model existing share ownership and the impact of multiple future investment rounds on your equity (and that of other early investors).

Model the number of shares you will need to issue (and at what price) to achieve your overall investment requirements.

So what’s stopping you? Use the investment round calculator now.

Updated 18 September 2023.

Anybody who’s run a growing business knows that keeping things on track is like spinning a dinner service’s worth of plates.

Fundraising is difficult. It doesn’t matter how experienced you are as an entrepreneur or what level your business is at - securing funding will...