Should I use unapproved share options or growth shares?

Updated 06 February 2024. We spend a lot of time talking to business owners about different types of shares. Quite often it’s not as simple as ‘this ...

Manage your equity and shareholders

Share schemes & options

Fundraising

Equity management

Start a business

Company valuations

Launch funds, evalute deals & invest

Special Purpose Vehicles (SPV)

Manage your portfolio

Model future scenarios

Powerful tools and five-star support

Employee share schemes

Predictable pricing and no hidden charges

For startups

For scaleups & SMEs

For larger companies

Ideas, insight and tools to help you grow

2 min read

Naveed Akram

:

18 January 2018

Naveed Akram

:

18 January 2018

Last updated: 6 February 2024.

EMI options, unapproved share options and growth shares all have their benefits, but one may be a better fit for your business. How do you decide which one? Comparing the net benefit each of your shareholders gets through each scheme can be a good place to start.

Usually, that might be a complicated and time-heavy task. That’s why we’ve created the EMI and unapproved options vs growth shares calculator, so you can quickly and simply compare the net benefit for your shareholders.

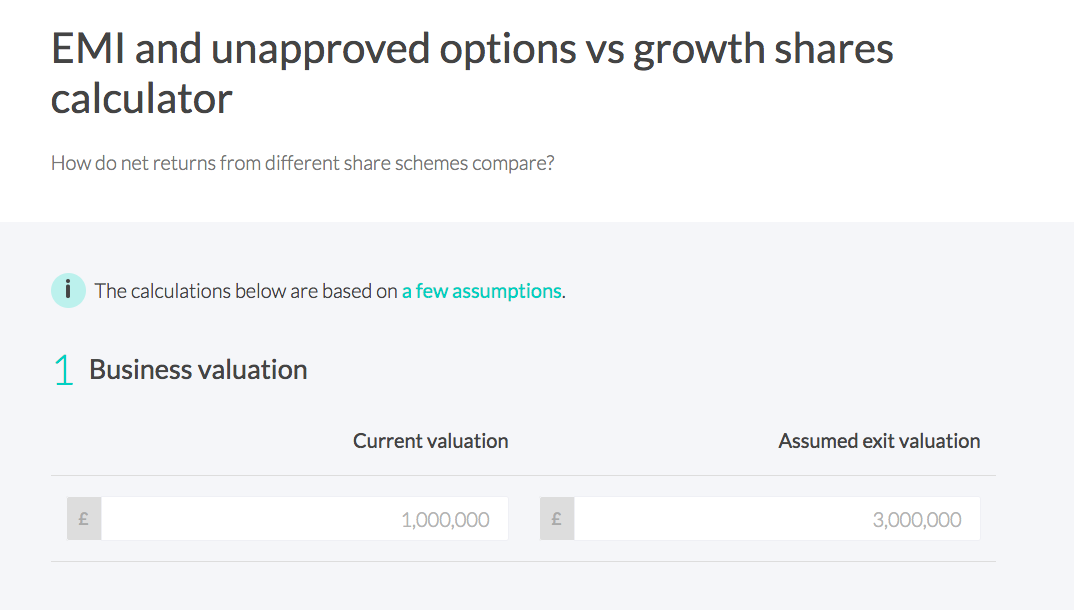

You start with an estimate of the business value today and assume a future exit valuation (you are allowed to dream at this stage, but it's more helpful to be objective).

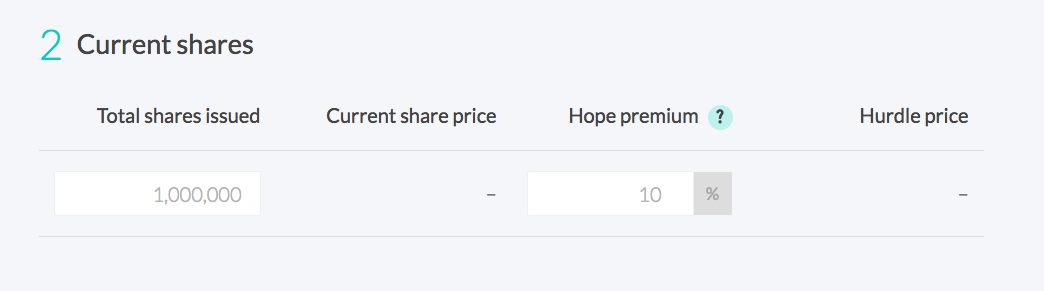

Enter the total number of shares you’ve issued and your hope premium. The calculator will then quickly work out your current share price.

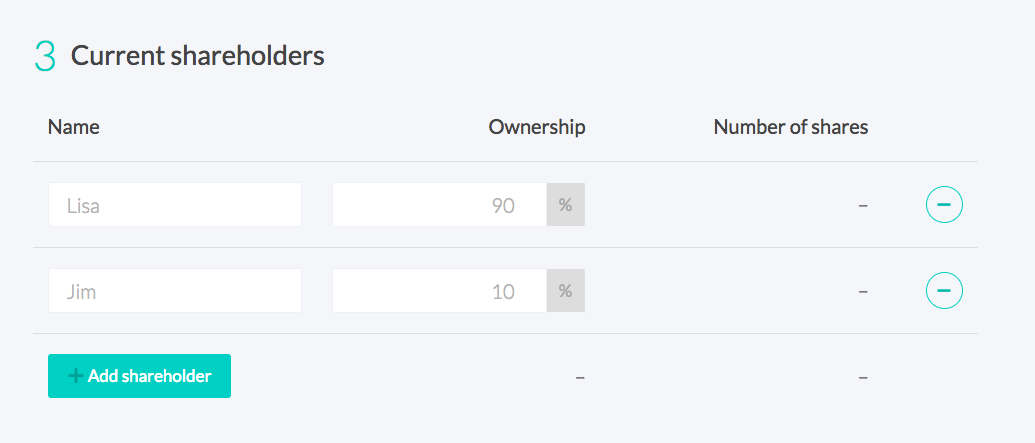

Just pop in their name and percentage of ownership. The calculator will tell you what that means in terms of number of shares.

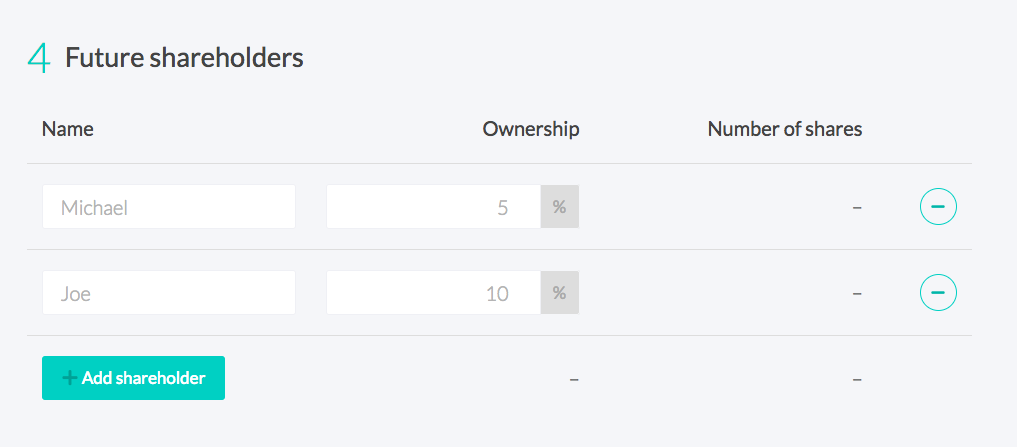

Same details as existing shareholders but for your lucky new ones.

This is the magic bit. From the information you’ve added the calculator has worked out the net benefit for each recipient for both EMI and for unapproved share options. So you can easily see which one works out best for your shareholders.

If you want to learn a bit more about the different options first, I’ve laid out some more information.

Her Majesty’s Government have also recognised the power of shared ownership and put together the Enterprise Management Incentive (EMI) scheme. The scheme not only allows you to reward your employees with share options with massive tax advantages but also allows you to offset the cost against any exit proceeds.

If you’re sharing ownership with your employees, an EMI scheme makes a lot of sense.

Unapproved options are pretty simple. They are also flexible and can be given to employees, contractors, advisors, consultants, you get the picture.

Another factor adding to the simplicity is that unapproved options don’t require any formal valuation or notification to HMRC when the options are set up (unlike EMI), although they do need to be included in an annual report to HMRC via ERS, if they have been given to employees or directors.

The big disadvantage with unapproved options is that there is no tax benefit for the recipient. The recipient is liable for income tax on the difference between the exercise price and the market value of the shares at the time.

An employee may also be liable to pay national insurance on this, if the shares are readily convertible to cash at the point of exercise (eg in a sale scenario).

Growth shares only share in the capital growth of the business from the point that they are issued.

For example, if they are issued at a hurdle of £1 per share, they will only share in any eventual net sale proceeds that are over and above £1 per share. This means that existing shareholders are only value diluted for growth from that point, rather than the existing worth of the company.

So, recipients of growth shares don’t have to pay income tax on exercise, only capital gains tax on sale (which is the same for unapproved options). This makes them pretty tax efficient for non-employees and, if you’ve previously used EMI options for employees, tax efficient for them too.

They can be issued immediately and (again, the same for unapproved options) it’s possible to set conditionality for the shares.

Why, then, would you choose unapproved options over growth shares when growth shares are more tax-efficient? Well, unapproved options are simpler: you don’t need to adopt new articles of association and they are much more commonly understood.

And, if the business has limited growth potential, say less than two or three times current, then unapproved options may actually be more efficient.

Try out the calculator now and find out which share scheme option is right for you and your shareholders.

Updated 06 February 2024. We spend a lot of time talking to business owners about different types of shares. Quite often it’s not as simple as ‘this ...

Updated 06 February 2024.

Last updated: 23 November 2023. There are many different ways to share ownership. EMI options are the most tax-efficient for your employees. Growth...