How to choose the best share scheme for your business

When you’re trying to work out which share scheme or share option scheme is best for your business, it’s hard to fight the urge to Google...

Share schemes & equity management for startups, scaleups and established UK companies.

With two-way Companies House integration, the platform is fast, accurate and powerful.

Manage your portfolio with ease and evaluate potential investments.

The platform is fully synced with Companies House, to provide you with accurate, real-time insight.

Add your investments for complete visibility of your shareholdings. View cap tables and detailed share movements.

Organise investments by fund, geography or sector, and view your portfolio as a whole or by individual company.

Explore future value scenarios based on various growth trajectories, to figure out potential payouts.

Remove friction and save time. Action shareholder resolutions via DocuSign, access data rooms, and get updates from founders.

Set up and manage new SPVs without leaving the platform, then invite co-investors to fund and participate.

1 min read

Naveed Akram

:

14 September 2017

Naveed Akram

:

14 September 2017

When you enter a room that’s full of people who all share your belief in the power of ownership, you know you’re going to have a good day. At the Employee Share Schemes for SMEs conference this year, everyone there not only grasped the immense value and benefit inherent in shared ownership, but was actively trying to implement or improve it in their own business.

It was a day packed with detailed advice and interesting conversations and with so much going on it’s easy for some of the key points to get forgotten. So whether you could attend or not, here our 6 key takeaways from the event.

1. “Employees will have more interest in growing share value if they themselves have shares in the business. Shareholders have shares. Employees have share schemes. This aligns both groups interests” David Craddock

2. “Biggest threat to European businesses is poor succession planning” Stephen Woodhouse

3. EOTs (employee ownership trusts) can avoid the common pains attached with 3rd party sales when founders want to release capital.

Nigel Mason

Nigel Mason

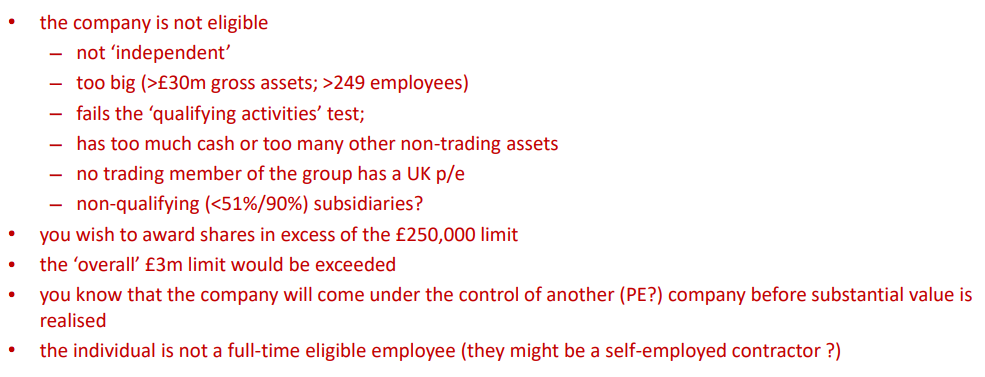

4. Reasons you could not grant and EMI option.

David Pett

David Pett

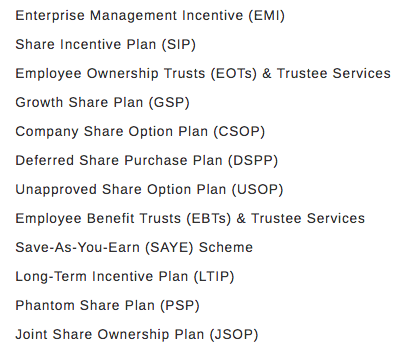

5. The variety of shares schemes available and their various restrictions can become incredibly complex (Nigel Mason)

Nigel Mason

Nigel Mason

6. Keep it as simple as possible. EMI and Growth Shares schemes consistently came up as the most tax advantageous, simple to implement and cost effective in most situations.

There were lots of interesting businesses there who I didn’t manage to talk to, but I’ll certainly be attending next year.

If you would like to chat about how Vestd could help you simplify your share scheme, please get in touch hello@vestd.com.

When you’re trying to work out which share scheme or share option scheme is best for your business, it’s hard to fight the urge to Google...

Last updated: 4th December 2023

When companies get seed investment from a crowdfunding raise or individual investors, it is often the case that a shareholder agreement (SHA) will be...